Trading Diary

August 16, 2002

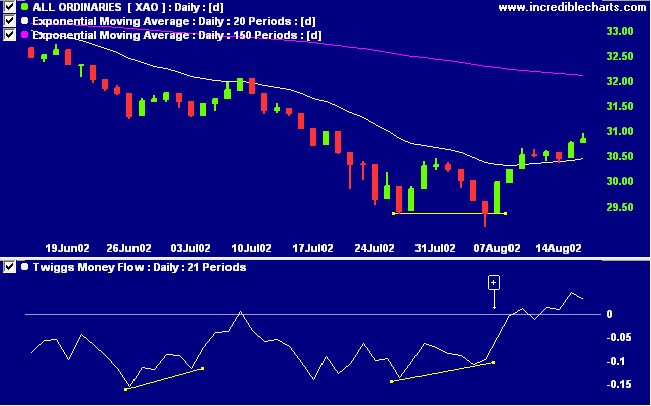

Primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator has given a bull alert signal, with a reading of 32% (August 14).

The Nasdaq Composite gained 1.2%, to close at 1361, above

resistance at 1355, signaling the start of a secondary

rally.

The primary cycle is in a down-trend.

The S&P 500 eased 2 points to close at 928. The primary cycle is in a down-trend.

A better-than-expected outlook from Dell sparked purchases of chip stocks. (more)

President Bush and Alan Greenspan are putting the best possible face on weak economic data. (more)

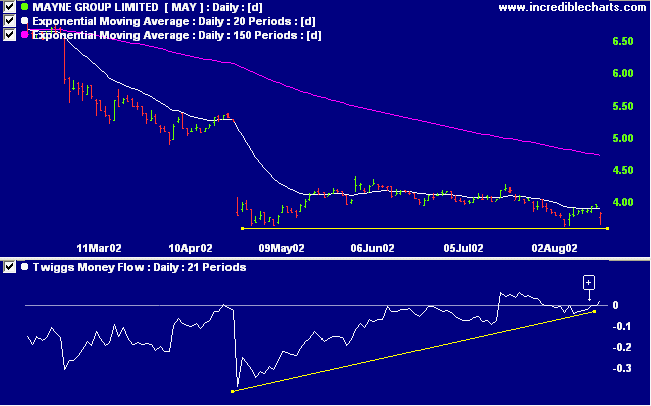

Mayne group stock fall 8% after warning of deteriorating earnings. (more)

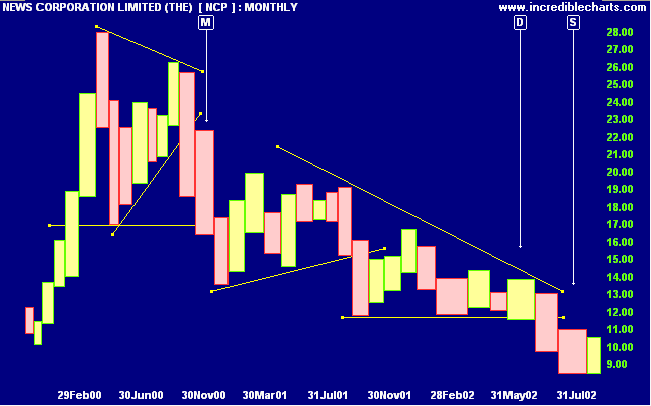

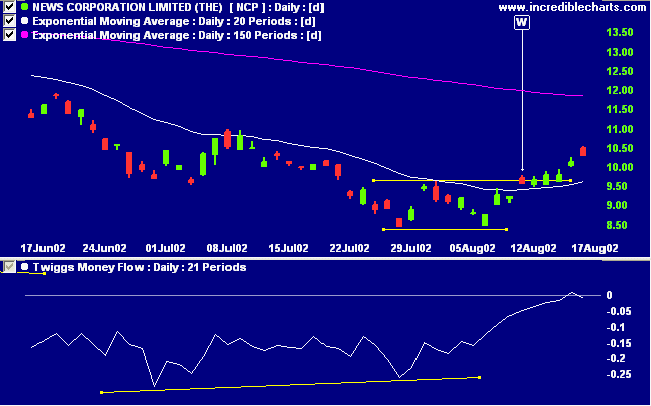

NCP has been in the news after the stock rallied more than 15% over the last 2 weeks, shortly after posting an Australian record loss. After completing a double top/symmetrical triangle at [M] the stock has been in a stage 4 decline, completing a descending triangle at [D] before falling to a new support level [S] at 8.40.

Interesting: the descending triangle is a bearish pattern with a calculated target of 4.42 .... only for the brave.

Stage changes are highlighted in bold.

- Energy [XEJ] - stage 1 (RS is rising)

- Materials [XMJ] - stage 4

- Industrials [XNJ] - stage 4 (RS is rising)

- Consumer Discretionary [XDJ] - stage 4

- Consumer Staples [XSJ] - stage 4 (RS is rising)

- Health Care [XHJ] - stage 4

- Property Trusts [XPJ] - stage 4 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is rising)

- Information Technology [XIJ] - stage 4

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) shows the strongest sectors as:

- Electric Utilities

- Construction Materials

- Diversified Commercial Services

...thou art no thy-lane, (alone)

In proving foresight may be vain:

The best laid schemes o' Mice an' Men,

Gang aft agley, (often go wrong)

An' lea'e us nought but grief an' pain,

For promis'd joy!

- Robert Burns, to an investment analyst.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.