Trading Diary

August 14, 2002

The Chartcraft NYSE Bullish % Indicator has given a bull alert signal, with a reading of 32% (August 13).

The Nasdaq Composite made a massive gain, more than 5%, to

close at 1334. Resistance is at 1355.

The primary cycle is in a down-trend.

The S&P 500 rallied 35 points, or 4%, to close at 919. This completes a bullish ascending triangle and signals a reversal of the primary cycle down-trend but for the fact that the cycle-length is 8 to 10 days, instead of the 15 days minimum for a valid secondary cycle movement.

Most companies have completed the certification of their financials with the SEC. There have been no major surprises so far. (more)

Troubled cable operator Adelphia Communications will restate results from 1999 to 2001.

The troubled airline seeks a $US 1.8 billion federal loan to stave off bankruptcy. (more)

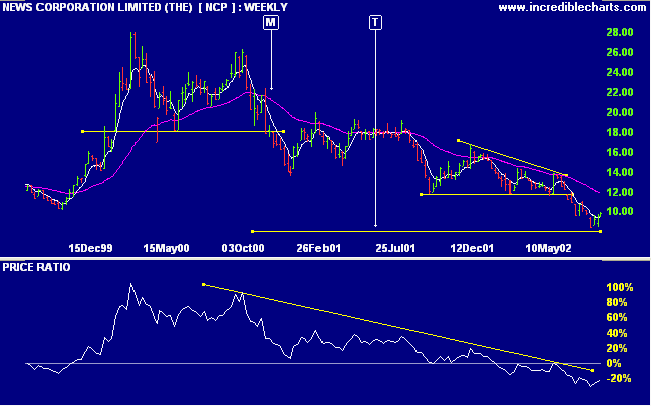

News Corporation reported an operating loss of $12 billion, including a further $3.5 billion write-down of Gemstar. (more)

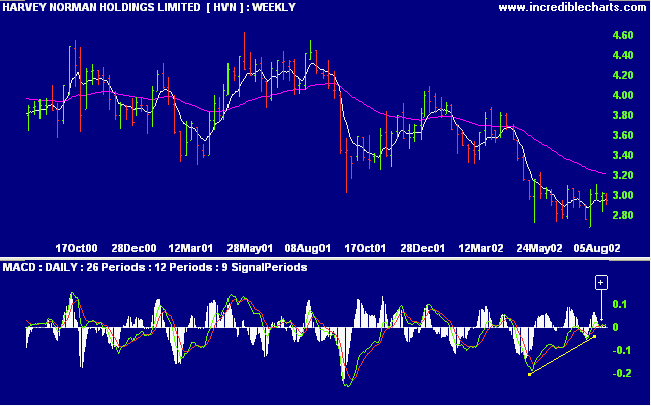

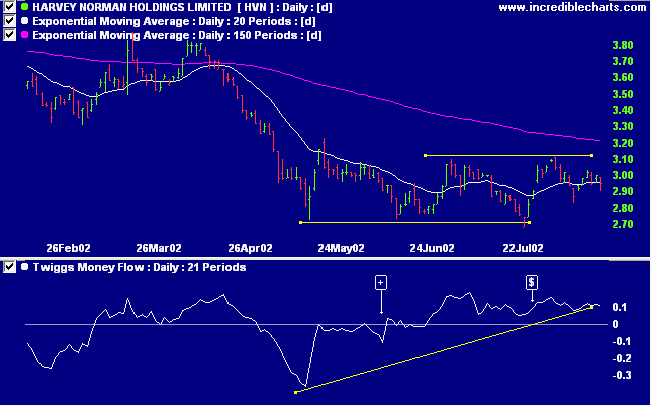

HVN has been in a stage 4 decline for the last year but is now starting to show some positive signs. Relative strength (price ratio: xao) is still weak but MACD shows a bullish divergence [+].

The man who is right always has two forces working in his favor - basic conditions and the men who are wrong.

- Edwin Lefevre.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.