Trading Diary

August 12, 2002

The primary cycle trend is downwards but a rally above 8806 will signal a reversal.

The Chartcraft NYSE Bullish % Indicator has given a bull alert signal, with a reading of 30% (August 9).

The Nasdaq Composite opened sharply lower but then rallied to

close unchanged at 1306.

The primary cycle is in a down-trend. Failure to reach the 1355

resistance level will be a bearish sign.

The S&P 500 declined 0.5% to 903.

The primary cycle trends downwards. A break above 912 will

signal a reversal.

The Federal Reserve meeting on Tuesday is unlikely to deliver the hoped-for rate cut. (more)

The yield on 10-year treasury notes closed at 4.22%, close to levels last seen in the 1960's. (more)

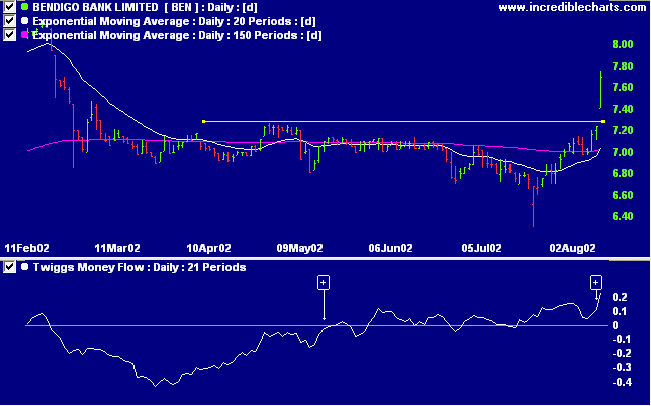

Bendigo announce a 47% increase in net profits to $48.8 million, with growth in all departments. (more)

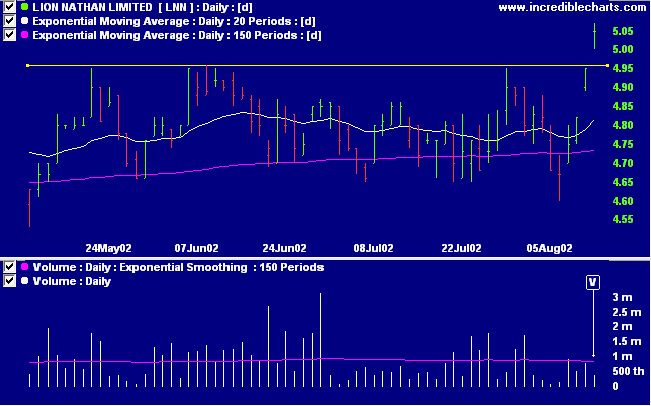

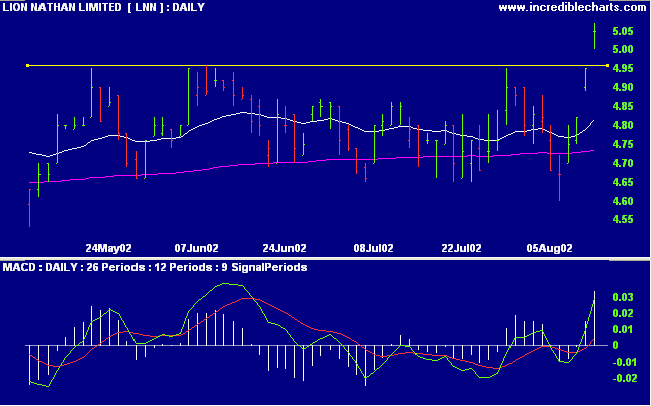

LNN has gapped up above recent highs but on disappointing volume [V]. Relative strength (price ratio: xao) and Twiggs money flow are positive, while MACD looks promising.

There is a tide in the affairs of men, which, taken at the flood leads on to fortune.

- William Shakespeare, on market timing.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.