Trading Diary

August 8, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow completed a follow-through on the third

day of the rally, rising 3% to close at 8712.

The primary cycle trend is downwards but a rally above 8806 will

signal a reversal.

The Chartcraft NYSE Bullish % Indicator has given a

bull alert signal, with a reading of 30% (August 7).

The Nasdaq Composite completed a

follow-through, rallying 2.8% to close at 1316. The primary

cycle is in a down-trend. A break above 1355 will signal a

reversal.

The S&P 500 rallied 29 points to close at

905, another follow-=through day.

The primary cycle trends downwards. A break above 912 will

signal a reversal.

ASX Australia

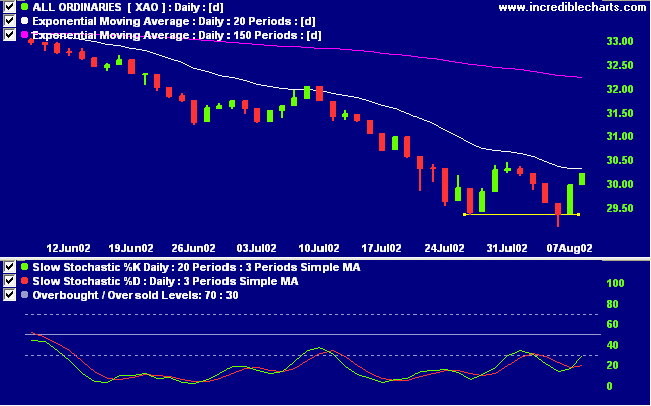

The All Ordinaries rallied a further 25 points

to close at 3024 on average volume. The primary cycle trends

down.

The Stochastic has joined MACD (26,12,9) above

its signal line. Twiggs money flow is improving.

No chart analysis today. I have been

re-visited by the 'flu and wouldn't trust anything I write to

make much sense.

Conclusion

Short-term: Long. Slow

Stochastic and MACD are above their respective signal

lines.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

Thought for the Day:

Common sense is not so common.

- Voltaire.

Back Issues

Back

Issues

Access the Trading Diary Archives.