Trading Diary

August 5, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow fell 3.2% to 8043, extinguishing any chance of a "V"

bottom. The primary cycle trends downwards.

The Chartcraft NYSE Bullish % Indicator has given a

bull alert signal, starting a new column with a reading of

30% (August 2).

The Nasdaq Composite fell 3.3% to close at 1206, close to the

1200 support level from July 24th. The primary cycle is in a

down-trend.

The S&P 500 down 30 points at 834, below the

follow-through day from last Monday.

The primary cycle trends downwards.

Slow service sector

The Institute for Supply Management service sector index

(retail, financial, construction and other non-manufacturing

activity) fell to 53.1 in July, from 57.2 in June.

(more)

Procter & Gamble

Cost savings helped turn around fourth-quarter earnings of 64

cents per share, compared to a loss of 23 cents a year earlier.

(more)

Cisco

Lehman Bros. downgrade Cisco, a day before the networking company

is to release its fourth-quarter earnings.

(more)

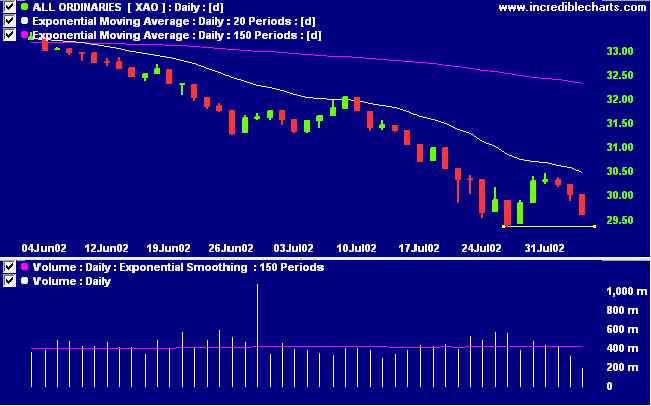

ASX Australia

The All Ordinaries closed down 42 points at 2961 on very low

volume. The index is still above the 2940 support level. The

primary cycle trends down.

Slow Stochastic (20,3,3) is below its signal line.

Exponentially-smoothed money flow signals distribution.

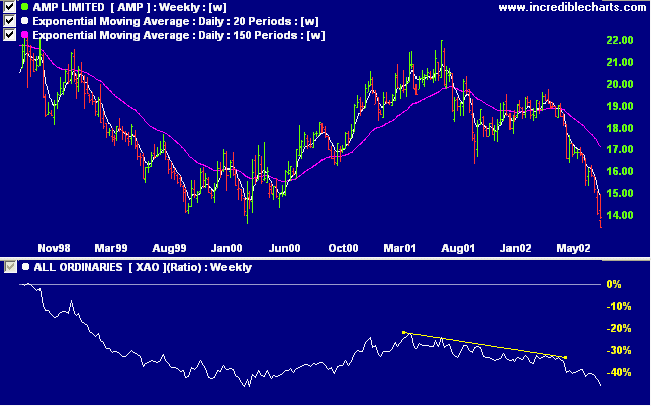

AMP [AMP]

AMP closed down at $13.44 after its recent profit warning, the

lowest price traded since its listing more than 4 years ago.

Relative strength (price ratio: xao), MACD and

exponentially-smoothed money flow are all weak.

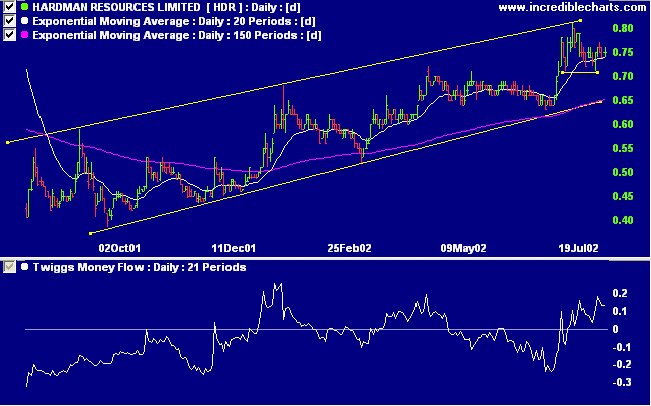

Hardman Resources [HDR]

HDR continues to trend strongly. Relative strength (price

ratio: xao) and MACD are positive, and Twiggs Money Flow has

crossed to above zero, signaling accumulation.

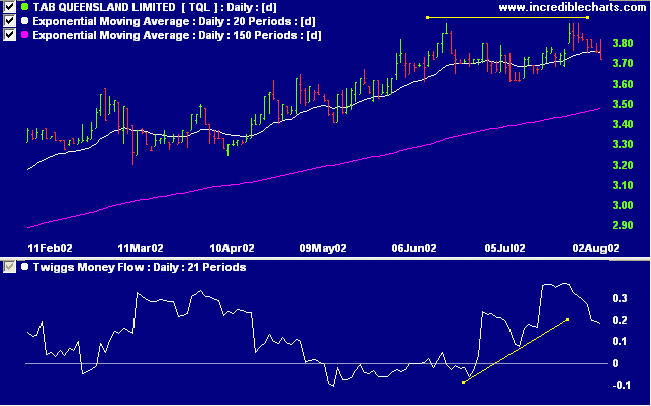

TAB Queensland [TQL]

TQL recently formed 2 equal highs at $ 3.90. Could this be a

double top forming? MACD was weaker on the second peak but

relative strength (price ratio: xao) is rising strongly and

Twiggs Money Flow shows strong accumulation on the second peak.

Conclusion

Short-term: Avoid new entries. Slow Stochastic and MACD are on

opposite sides of their respective signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

The bow that is always bent will soon cease to shoot

straight.

- Old proverb.

Back Issues

Back

Issues

Access the Trading Diary Archives.