Trading Diary

August 1, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow fell 2.6% to 8506, holding above Monday's

follow-through. The primary cycle trends downwards.

The Chartcraft NYSE Bullish % Indicator has a

reading of 24% (July 31). See

Bullish % Index for more details.

The Nasdaq Composite dropped 3.6% to 1280 but has not yet

closed the breakaway gap from Monday's

follow-through. Primary cycle is still in a down-trend.

The S&P 500 closed 27 points down at 884, testing the

follow-through day from Monday.

The primary cycle trends downwards.

Manufacturing growth slows

The Institute of Supply Management factory index fell to 50.5

in July, from 56.2 in June.

(more)

Disney down

Disney records a drop in third-quarter earnings and warns on

fourth-quarter performance.

(more)

ExxonMobil

The oil and gas giant reported a 40% drop in second-quarter

earnings per share.

(more)

Stephen Roach on the US economy

Morgan Stanley's chief global economist takes stock of the US

economy.

(more)

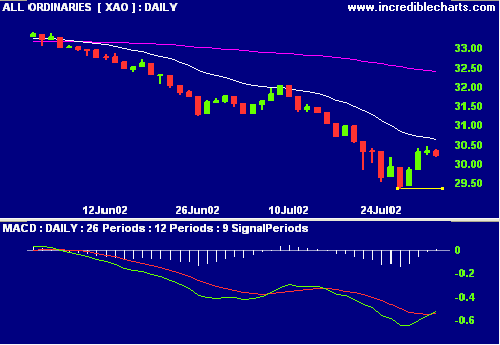

ASX Australia

The All Ordinaries consolidation continues, closing down 9 points at 3024 on average

volume. It is important that the next week hold above the 2940

support level.

The primary cycle trends down.

MACD (26,12,9) has joined Slow Stochastic (20,3,3) above its

signal line. Exponentially-smoothed money flow signals

distribution.

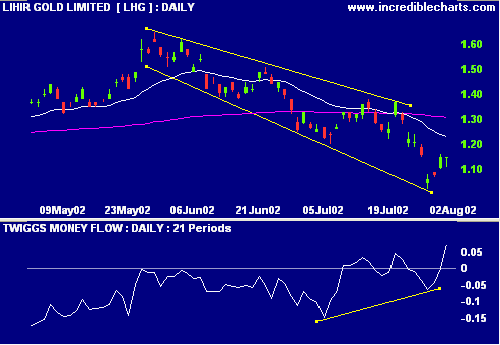

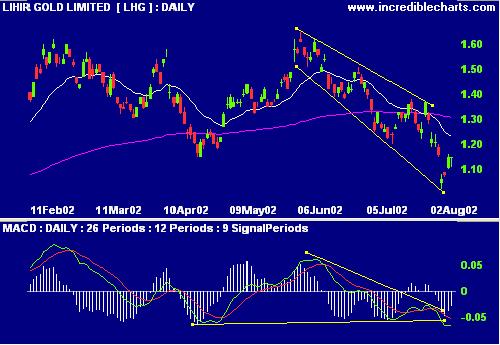

Lihir Gold [LHG]

LHG is entering a stage 4 decline, with 20-day moving average

crossing below the 150-day moving average. Relative strength

(price ratio: xao) is declining and MACD is weak but

exponentially-smoothed money flow displays a bearish

divergence.

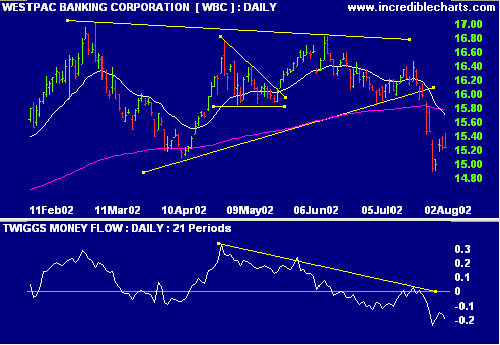

Westpac off target [WPC]

Chief executive David Morgan told analysts that the bank is

likely to miss its growth target for this year, citing poor

equity markets and "some bad news on the corporate debt side"

as the cause.

(more)

WBC recently broke down from a large triangle. Relative

strength (price ratio: xao) is still positive but

exponentially-smoothed money flow and MACD show weakness.

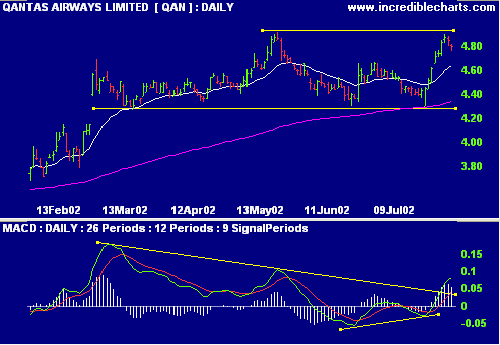

Qantas strike action [QAN]

More than 6000 of the airline's staff strike over pay demands.

(more)

QAN is in a trading range between 4.30 and 4.90. Relative

strength (price ratio: xao), exponentially-smoothed money flow

and MACD are all positive.

Conclusion

Short-term: Be cautious in long. Slow Stochastic and MACD are

above their respective signal lines but exponentially-smoothed

money flow signals distribution.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

It is not the strength of the body that matters, but the

strength of the spirit.

- J.R.Tolkien.

Back Issues

Back

Issues

Access the Trading Diary Archives.