Trading Diary

July 30, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow closed down marginally at 8680. Yesterday's

follow-through day was confirmed by increased volume. The

primary cycle trends downwards.

The Chartcraft NYSE Bullish % Indicator has a

reading of 24% (July 29). See

Bullish % Index for more details.

The Nasdaq Composite rallied a further two-thirds of 1%,

closing at 1344. Yesterday's

follow-through was confirmed by increased volume. Primary

cycle is still in a down-trend.

The S&P 500 rose 4 points to close at 902.

The primary cycle trends downwards.

IBM goes shopping

IBM is to buy Pricewaterhouse Coopers consulting arm for $US

3.5 billion.

(more)

Washington pushes through corporate reform law

President Bush signed the new bill into law, including an

accounting oversight board, tougher penalties for corporate fraud

and additional funding for the SEC.

(more)

Market fall weighs on consumer confidence

The Conference Board consumer confidence index, completed on July

24th, records a drop of almost 10% from June.

(more)

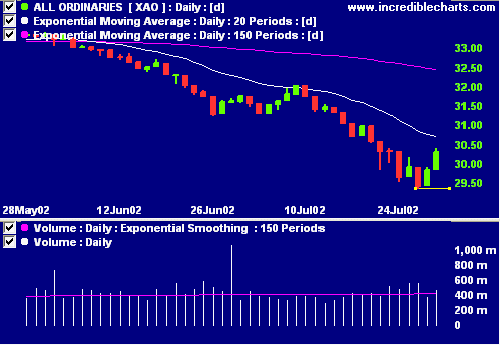

ASX Australia

The All Ordinaries rallied a further 46 points to close at 3030

on above-average volume. The first 2 days of a rally/correction

tend to be unreliable because of initial exuberance. It is

important that the next week hold above the 2940 support level.

The primary cycle trends down.

Slow Stochastic (20,3,3) is above its signal line.

Exponentially-smoothed money is rising but still below zero.

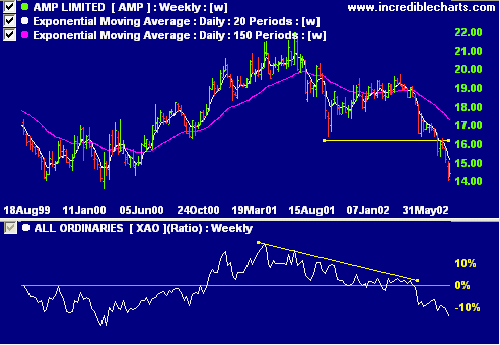

AMP gets AA- [AMP]

Standard & Poor's lowers the credit rating on key AMP

subsidiaries, following the recent warning by AMP that it would

not meet profit targets.

(more)

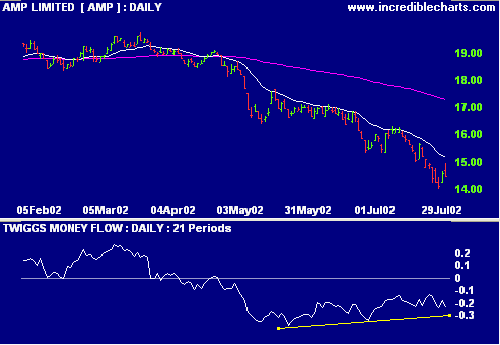

AMP is in a stage 4 decline with falling relative strength and

MACD. Exponentially-smoothed money flow shows a bullish

divergence.

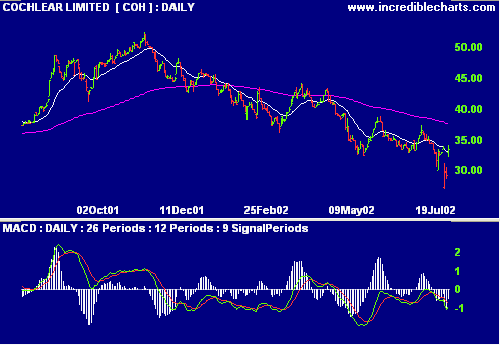

Cochlear [COH]

Major competitor Advanced Bionics withdraws its hearing aid

after the FDA warning about meningitis.

(more)

I find it strange that the stock has surged on the news as COH

must be facing similar risks to its US rival. Relative strength

(price ratio: xao) and exponentially-smoothed money flow are

improving but MACD looks weak.

Conclusion

Short-term: Avoid new entries. The Slow Stochastic and MACD

are on opposite sides of their respective signal lines. Keep

stops tight.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

When the going gets tough, the tough go

shopping.

Back Issues

Back

Issues

Access the Trading Diary Archives.