Trading Diary

July 26, 2002

The Chartcraft NYSE Bullish % Indicator has a reading of 24% (July 25). See Bullish % Index for more details.

The Nasdaq Composite formed a second inside day, rising 1.8% to close at 1262. Primary and secondary cycles are in a down-trend.

The S&P 500 closed up 14 points at 852.

Primary and secondary cycles trend downwards.

Trading Diary

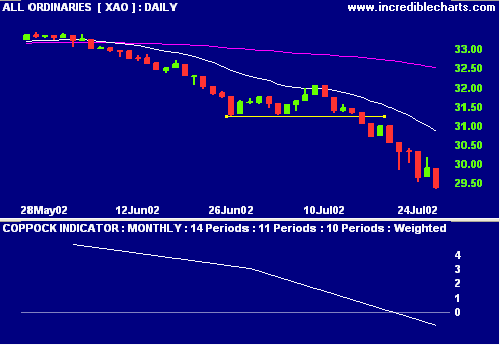

The primary cycle and secondary cycles trend down. The next

support level is 2828, from September 2001

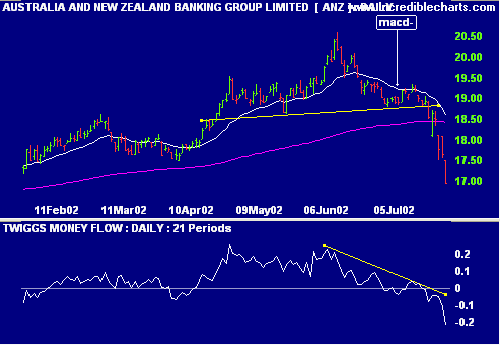

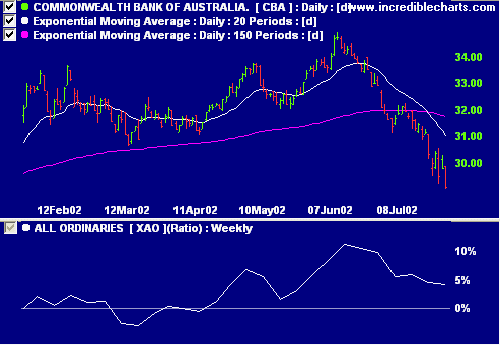

Bad debt concerns weaken bank stocks [ANZ]

Bank stocks have declined since ANZ disclosed its exposure to

troubled UK Marconi group. (more)

Stage changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is rising)

- Materials [XMJ] - stage 4

- Industrials [XNJ] - stage 4 (RS is rising)

- Consumer Discretionary [XDJ] - stage 4

- Consumer Staples [XSJ] - stage 4 (RS is rising)

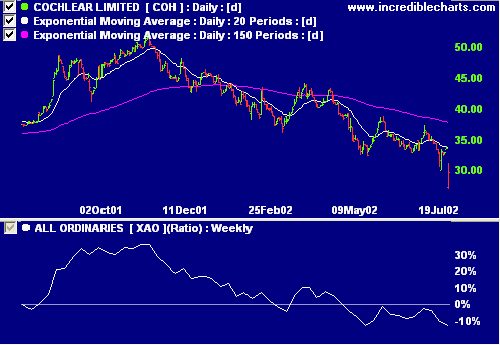

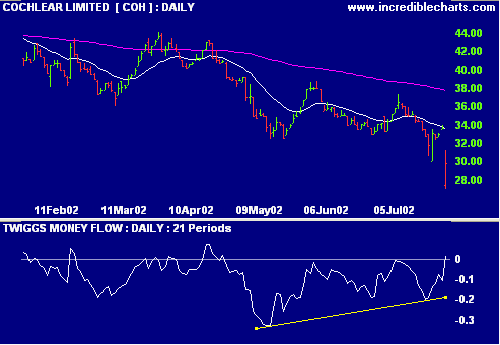

- Health Care [XHJ] - stage 4

- Property Trusts [XPJ] - stage 3 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4

- Information Technology [XIJ] - stage 4

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 1 (RS is rising)

A stock screen of equities using % Price Move (1 month: +10%) is dominated by:

- Application Software

- Diversified Financial Services

- Diversified Metals & Mining

- Gold

- Internet Software & Services

- Oil & Gas Exploration & Production

- Real Estate Management & Development

I think it would be a good idea.

- Mahatma Ghandi, when asked what he thought of Western civilization.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.