Trading Diary

July 24, 2002

The Chartcraft NYSE Bullish % Indicator has now entered oversold territory. See Bullish % Index for more details.

The Nasdaq Composite rose 5% to close at 1290. Primary and secondary cycles are in a down-trend.

The S&P 500 rallied 45 points to close at 843.

Primary and secondary cycles trend downwards.

The S&P 500 formed a strong key reversal signal, while the Dow formed a weaker pivot point reversal and the Nasdaq just failed to complete a reversal signal. These are short-term signals and it will take at least a week before we know whether this is a "V" bottom, as in September 2001, or a "sucker rally". The major bottoms in the past 40 years were:

1962 - ascending triangle

1970 - ascending triangle

1974 - double bottom

1980 - ascending triangle

1988 - ascending triangle (long)

1990 - symmetrical triangle

1998 - double bottom

2001 - "V" bottom

Bears will remind us that in 1985 the dividend yield on the Dow was 4.5%. This fell to 3.0% in 1987 before retreating to 4.5% after the crash. In 2002, the yield has just recovered above 2% after falling to almost 1.5%.

Trading Diary

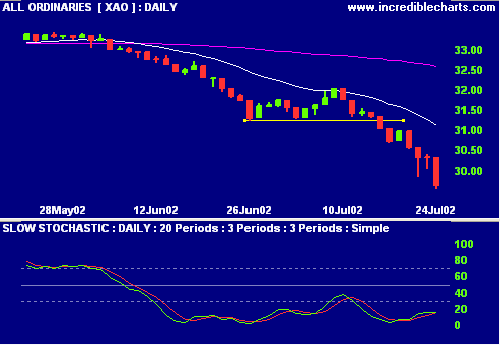

The primary cycle and secondary cycles trend down. The next

support level is 2828, from September 2001

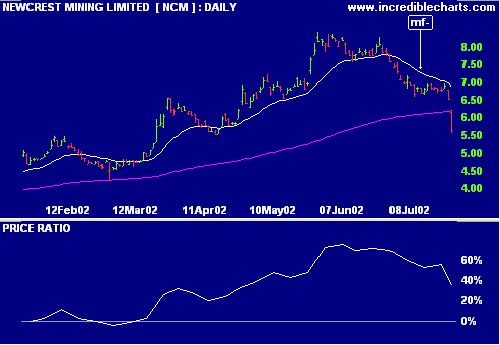

Newcrest Mining [NCM] has experienced even steeper falls with declining relative strength (price ratio: xao) and MACD, and exponentially-smoothed money flow falling sharply.

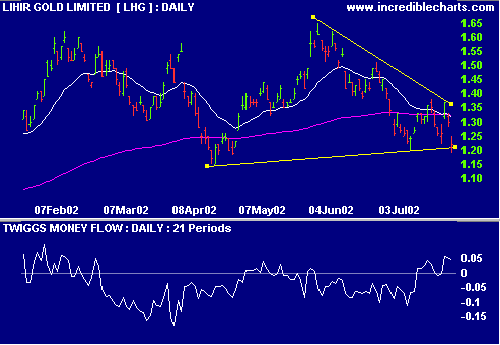

Lihir Gold [LHG] is threatening to break out on the downside of a triangle. Relative strength (price ratio: xao) and MACD are weak but exponentially-smoothed money flow still shows accumulation.

One of the most helpful things that anybody can learn is to give up trying to catch the last eighth - or the first.

These two are the most expensive eighths in the world. - Edwin Lefevre.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.