Trading Diary

July 23, 2002

These extracts from my daily trading diary are intended to

illustrate the techniques used in short-term trading and should

not be interpreted as investment advice. Full terms and

conditions can be found at

Terms

of Use .

USA

The Dow fell a further 1% to close at 7702. The next major

support level is 7379, from July 1998. We are now in the third

phase of the

bear market. Primary and secondary cycles trend downwards.

Telecom stocks continued their slide, with the Nasdaq Composite

losing more than 4% to close at 1229. The next major support

level is 1194, from July 1997. Primary and secondary cycles are

in a down-trend.

The S&P 500 lost a further 22 points to close at 797. The

next support level is 733, from April 1997.

Primary and secondary cycles trend downwards.

Banks face Enron probe

Citigroup and JP Morgan Chase face allegations that they helped

to hide the extent of Enron's debt.

(more)

Amazon narrows loss

Amazon.com reported a second-quarter loss of 25 cents per share

after all charges, compared to 47 cents a year earlier.

(more)

Dollar rises, gold sinks

The dollar rose to its highest level in 2 weeks while August gold

futures fell to $US 312.60

(more)

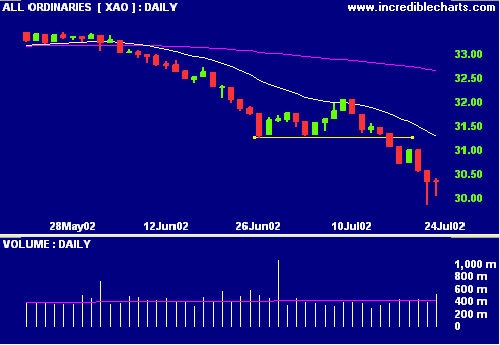

ASX Australia

The All Ordinaries recovered from a sharp drop in the morning to

close 1 point down at 3034 on strong volume.

The primary cycle and secondary cycle trend down, while strong

support is shaping between 3000 and 3035.

Slow Stochastic (20,3,3) is above its signal line while MACD

(26,12,9) is below. Exponentially-smoothed money flow signals

distribution.

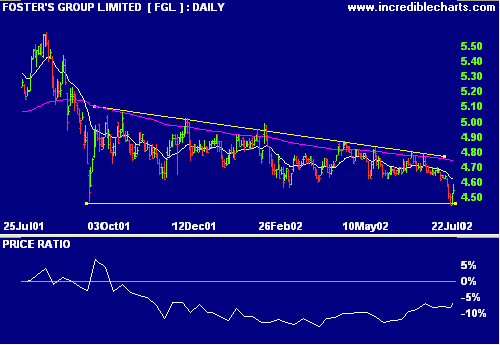

Fosters share buy-back [FGL]

Fosters Group are to buy back 2.5% of their ordinary shares.

(more)

Relative strength (price ratio: xao) is improving but MACD and

exponentially-smoothed money flow are weak.

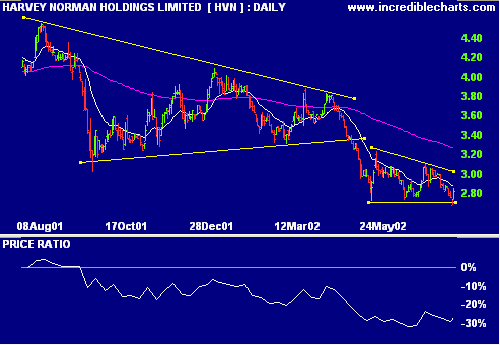

Harvey Norman [HVN]

Fourth-quarter same-store sales were up 7.4% on a year earlier.

(more)

The descending triangle is a bearish signal. Relative Strength

(price ratio: xao) is weak, while exponentially-smoothed money

flow and MACD are improving.

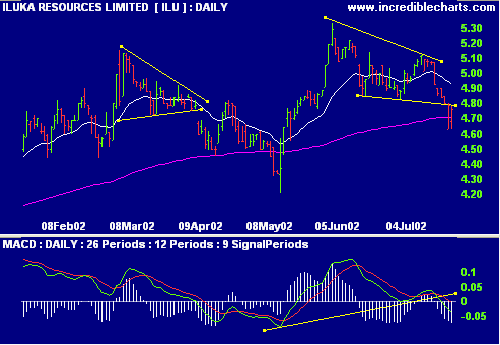

Iluka Resources [ILU]

Iluka report a 16% increase in their Murray Basin mineral

sands resources, after a fall in second-quarter production.

(more)

Relative Strength (price ratio: xao) is positive but

exponentially-smoothed money flow and MACD are weakening.

Conclusion

Short-term: Avoid new entries. The Slow Stochastic is above,

and MACD below, its signal line.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

CNN/Gallop Poll conducted a survey over this past weekend,

asking who was to blame for individual stock losses.

a) CEO's

b) brokers

c) media

d) government

e) self

No surprise. Only two percent accepted responsibility for

their own actions.

God Bless America!

Back Issues

Back

Issues

Access the Trading Diary Archives.