Trading Diary

July 22, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow fell almost 3% to close at 7784, below

the key 8000 support level. The next major support level is 7379,

from July 1998. We are now in the third phase of the

bear market. Primary and secondary cycles trend

downwards.

The Nasdaq Composite lost 2.7% to close at

1282, below the October 1998 support level. The next major

support level is at 1194, from July 1997. The primary and

secondary cycles are in a down-trend.

The S&P 500 dropped 28 points to close at

819. The next support level is 733, from April 1997.

Primary and secondary cycles trend downwards.

American Express

Second-quarter earnings of 51 cents per share

tops analysts estimates (earnings were 13 cents a year

earlier). (more)

Telecom

WorldCom files for bankruptcy and BellSouth reports a drop in

second-quarter sales and earnings.

(more)

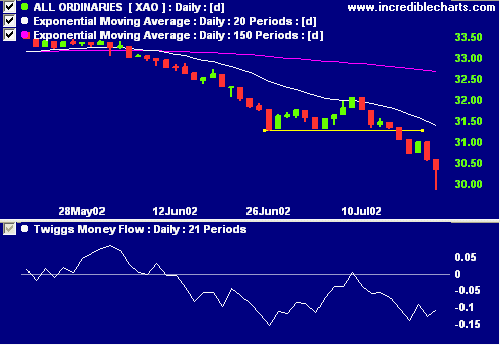

ASX Australia

After plummeting more than 70 points, the All Ordinaries

recovered to close down 23 points at 3035 on average volume.

The primary cycle and secondary cycle are in a bear trend.

The candlestick

hammer

shows support at current levels. Slow Stochastic (20,3,3) is

above its signal line while MACD (26,12,9) is below.

Exponentially-smoothed money flow signals distribution.

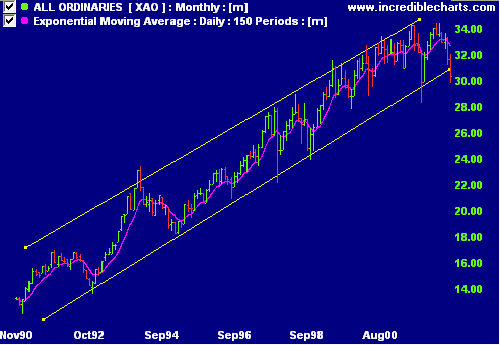

At times like this it pays to take a long-term view of the

market.

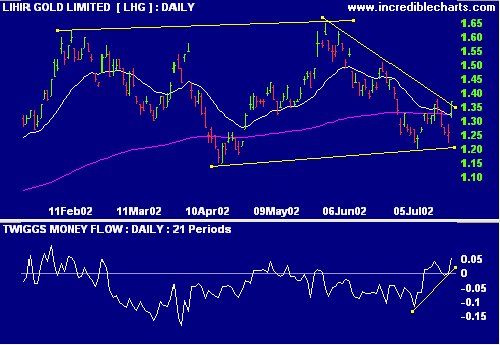

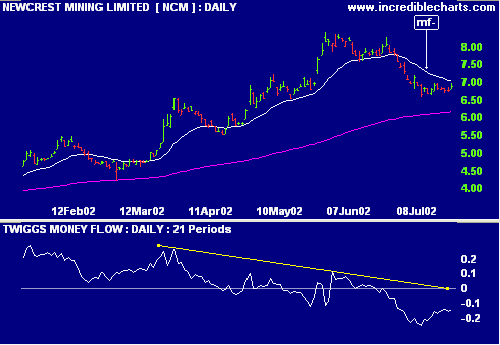

Gold stocks

Gold stocks were able to avoid the general slide.

(more)

Lihir Gold has formed a triangle and is

threatening an upward breakout, with positive relative strength

(price ratio: xao), improving MACD and exponentially-smoothed

money flow signaling accumulation.

Newcrest Mining [NCM] looks weaker, with declining MACD and

exponentially-smoothed money flow.

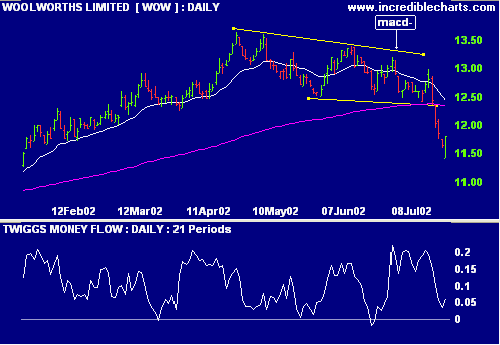

Woolworths [WOW]

CEO Roger Corbett says Woolworths can increase earnings by low

double-digit percentage rates and achieve sales growth in the

high single digits "for the foreseeable future".

(more)

Relative Strength (price ratio: xao) is

positive and exponentially-smoothed money flow holds above

zero. MACD is negative.

Conclusion

Short-term: Avoid new entries. The Slow Stochastic is above, and

MACD below, its signal line.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

Just because a stock has fallen doesn't mean that it's cheap.

Be selective.

Back Issues

Back

Issues

Access the Trading Diary Archives.