Trading Diary

July 19, 2002

The Nasdaq Composite lost 2.8% to close at

1319, below the 1357 October 1998 support level.

The primary and secondary cycles are in a down-trend.

The S&P 500 dropped 34 points to close at

847. The next support level is 804, from April 1997.

Primary and secondary cycles trend downwards.

Sun Microsystems stock dropped 27% after the company lowered 2003 revenue and earnings forecasts. (more)

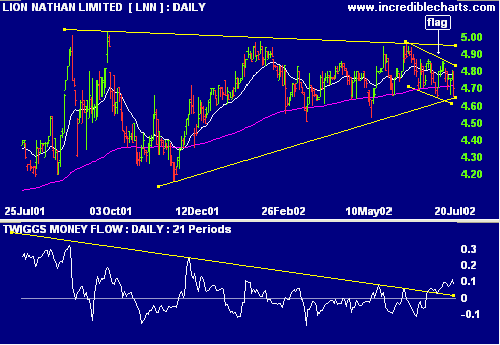

LNN has formed a similar triangle but has not yet made a breakout. Relative Strength (price ratio: xao) is strong, MACD is neutral, while exponentially-smoothed money flow signals accumulation during the recent flag pattern.

Stage changes are highlighted in bold.

- Energy [XEJ] - stage 1

- Materials [XMJ] - stage 4 (RS is rising)

- Industrials [XNJ] - stage 4

- Consumer Discretionary [XDJ] - stage 4

- Consumer Staples [XSJ] - stage 4

- Health Care [XHJ] - stage 4

- Property Trusts [XPJ] - stage 3

- Financial excl. Property Trusts [XXJ] - stage 4

- Information Technology [XIJ] - stage 4

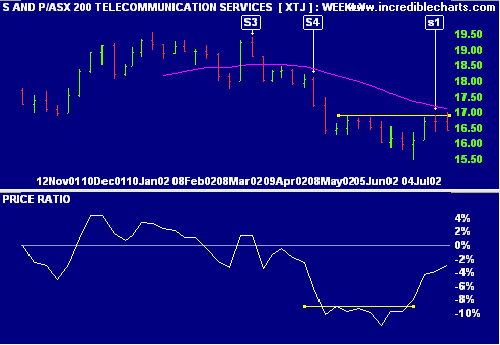

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 1 (RS is rising)

The ASX has ceased to provide the old ASX indices.

A stock screen of equities using % Price Move (3 months: +10%) is dominated by:

- Base Metals

- Computer & Office

- Diversified Media

- Gold Explorers

- Gold Producers

- Mining Explorers

- Miscellaneous Industrials

- Miscellaneous Services

- Oil & Gas Explorers

- Oil & Gas Producers

There are a few really outstanding companies, whose stock normally sells at a substantial premium, except in the final throes of a bear market.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.