Trading Diary

July 18, 2002

The Nasdaq Composite lost 2.9% to close at

1356. The index is at the October 1998 support level.

The primary and secondary cycles are in a down-trend.

The S&P 500 dropped 25 points to close at

881, below the October 1998 support level.

Primary and secondary cycles trend downwards.

Advanced Micro Devices reported a second-quarter loss of 54 cents per share, compared to 5 cents for the same period last year. (more)

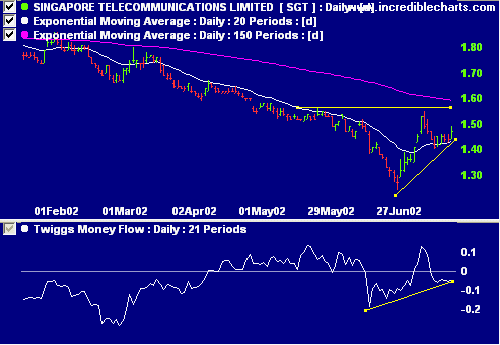

Singapore Telecom [STT] shows a bullish, ascending

triangle. A break above 1.55 would have a target of 1.86

(1.55 + (1.55 - 1.24)). The 150-day

moving average is declining and relative strength (price

ratio: xao) is still weak but MACD and

exponentially-smoothed Money Flow are

improving.

Small investors tend to be pessimistic and optimistic at precisely the wrong times, so it's self-defeating to try to invest in good markets and get out of bad ones. - Peter Lynch

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.