Trading Diary

July 12, 2002

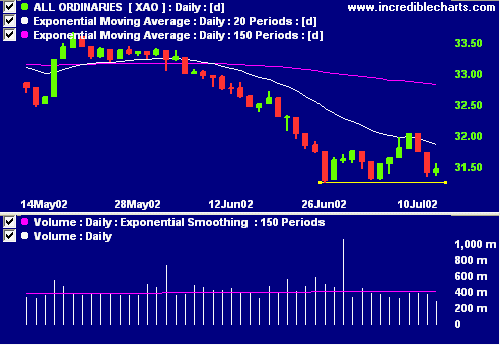

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite opened strongly but later

weakened to close almost unchanged at 1373.

The primary and secondary cycles are in a down-trend.

The S&P 500 lost 6 points to close at

921.

Primary and secondary cycles trend downwards.

Robertson Stephens, formerly the 8th biggest US equity underwriter is to shut its doors after the owner FleetBoston Financial fails to find a buyer. (more)

The network gear maker reports second-quarter earnings ahead of expectations. (more)

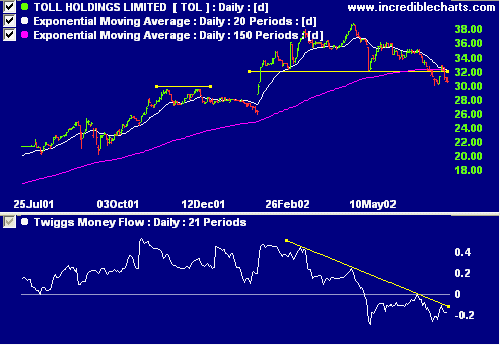

Toll Holdings [TOL]

TOL has completed a broad

head and shoulders reversal pattern with a calculated

target of $25.50. Relative Strength (price ratio: xao) is

weakening, while MACD and exponentially-smoothed Money Flow

show bearish divergences.

Stage changes are highlighted in red.

- Energy [XEJ] - stage 1

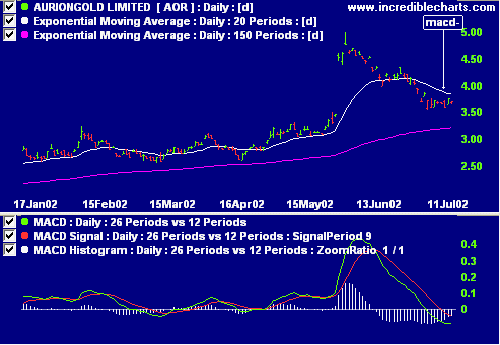

- Materials [XMJ] - stage 3 (RS is rising

- Industrials [XNJ] - stage 4

- Consumer Discretionary [XDJ] - stage 4

- Consumer Staples [XSJ] - stage 4

- Health Care [XHJ] - stage 4

- Property Trusts [XPJ] - stage 2

- Financial excl. Property Trusts [XXJ] - stage 3

- Information Technology [XIJ] - stage 4

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 1

The ASX has ceased to provide the old ASX indices.

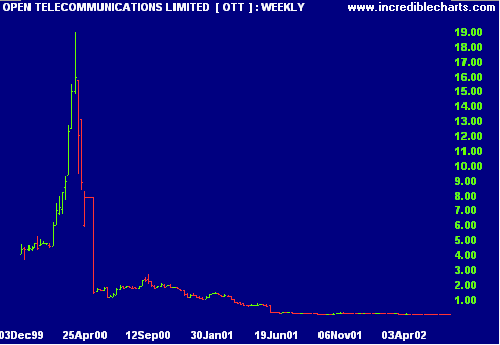

A stock screen of equities using % Price Move (1 month: +10%, 1 year: +30%) is dominated by Gold Explorers (Producers are notably absent), Oil & Gas Producers and Mining Explorers.

It was the same with all. They would not take a small loss at first but had held on, in the hope of a recovery that would "let them out even". And prices had sunk and sunk until the loss was so great that it seemed only proper to hold on, if need be a year, for sooner or later prices must come back. But the break "shook them out" and prices just went so much lower because so many people had to sell, whether they would or not.

-- Edwin Lefevre.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.