Trading Diary

July 10, 2002

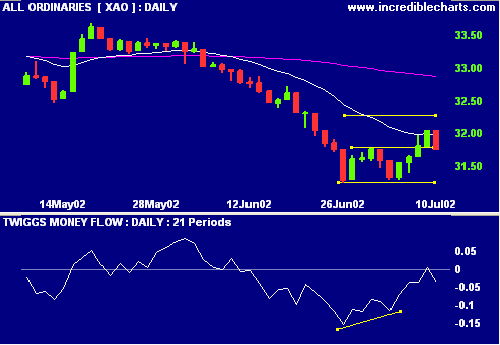

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite fell a further 2.5% to

close at 1346, below September 2001 levels.

The primary and secondary cycles are in a down-trend.

The S&P 500 lost 32 points to close at

920, the lowest level since January '98.

Primary and secondary cycles trend downwards.

Safe haven stocks, especially drug companies, were sold down sharply. New entries to the reshuffled S&P 500 (EBay, Goldman Sachs, UPS and Prudential) are amongst the few gainers. (more)

Gold and silver decline against a more stable dollar, August gold futures close at $US 315.10. (more)

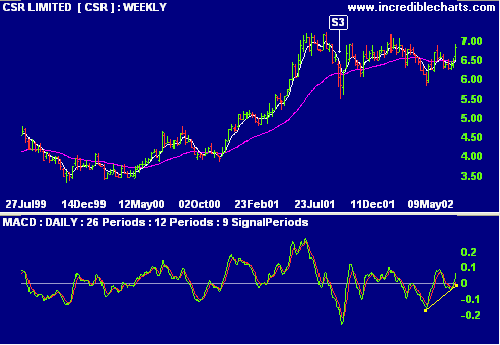

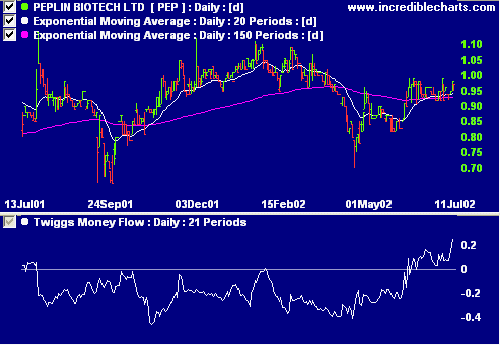

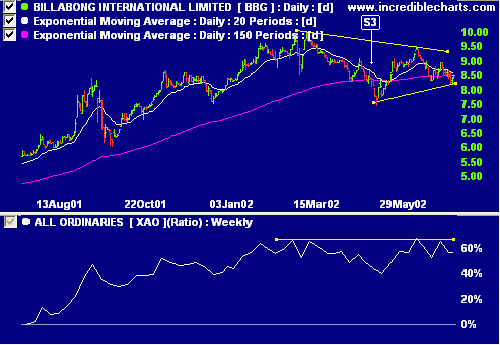

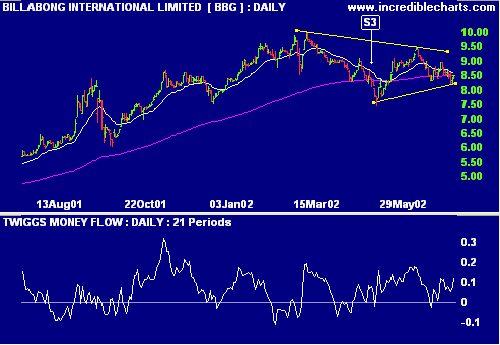

Relative Strength (price ratio: xao) and MACD are improving, while exponentially-smoothed Money Flow has swung to accumulation.

When the going gets tough, the tough go shopping. - Unknown.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.