Trading Diary

July 3, 2002

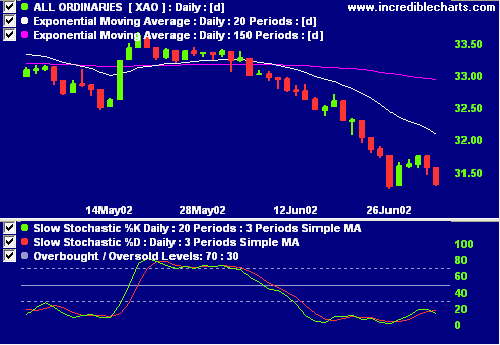

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite gained 1.6% to close at

1380.

The primary and secondary cycles are in a down-trend.

The S&P 500 rose 5 points to 953.

Primary and secondary cycles trend downwards.

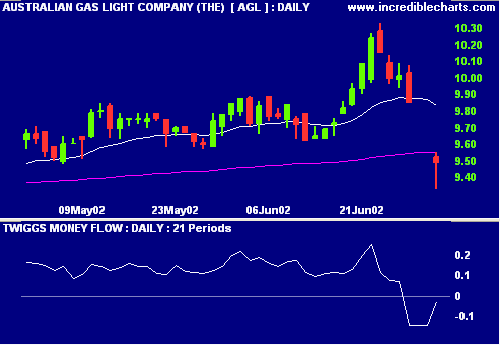

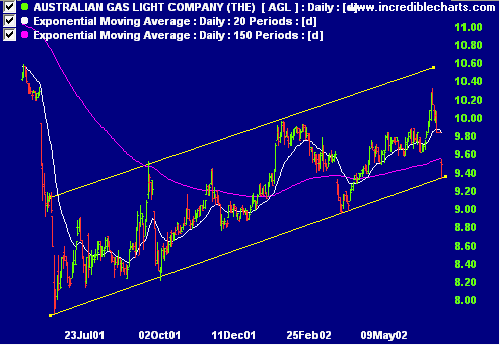

A reader sent me a chart of AGL depicting channel lines. I am not a big user of channel lines myself but I must admit that they have worked very well on AGL over the last 12 months.

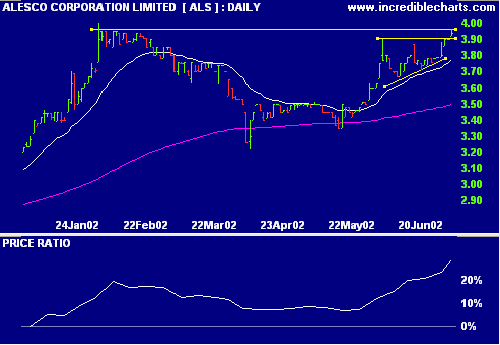

ALS has broken through resistance at $3.90 and is testing further resistance levels at $3.95 to $4.00. Relative Strength (price ratio: xao) and exponentially-smoothed Money Flow are strong, while MACD is bullish. Caution: volumes are low.

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.