Trading Diary

July 1, 2002

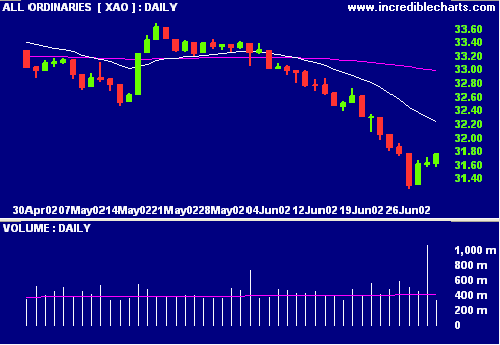

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite plummeted 4% to close

just above last September lows at 1403.

The primary and secondary cycles are in a down-trend.

The S&P 500 is again testing the September

2001 support level, closing down 21 points at 968.

Primary and secondary cycles trend downwards.

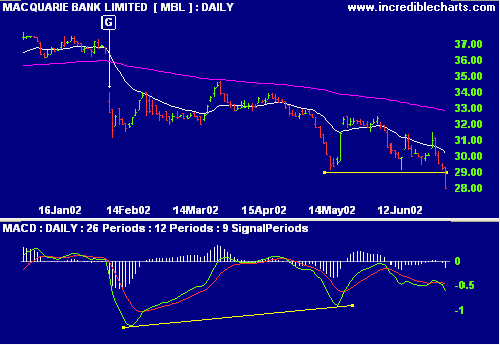

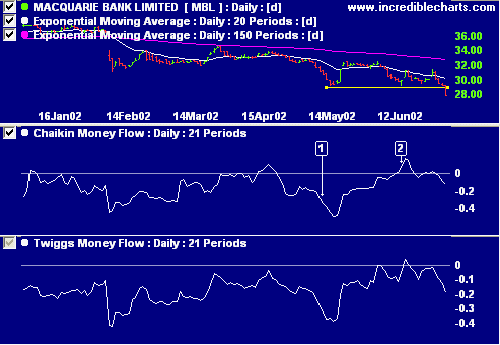

MBL recorded a new 1-year low, closing at $27.98.

Note the distortion caused by an unusually sharp down move on Chaikin Money Flow day [1]. The indicator ticks up sharply 22 days later, on day [2], when data from day [1] is dropped. The second Money Flow indicator uses an exponentially-smoothed formula for more accurate results. Please ignore the name - I have not yet decided what to call it.

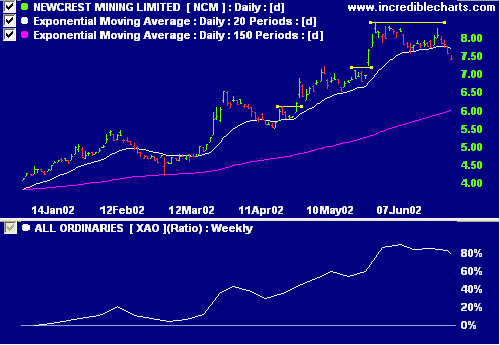

Newcrest Mining is one of several gold producers entering a secondary correction.

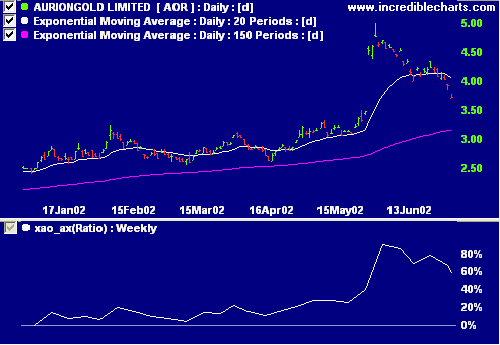

AurionGold [AOR] has declined after directors rejected the Placer Dome offer.

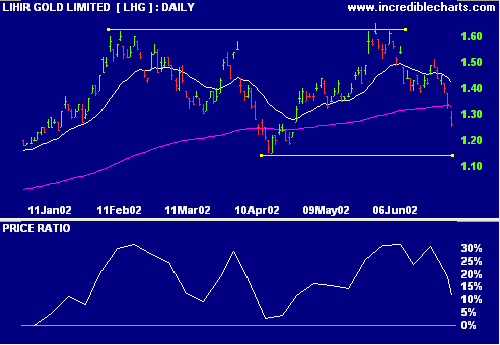

Lihir Gold [LHG] will complete a major double top if it descends below $1.15.

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.