Trading Diary

June 26, 2002

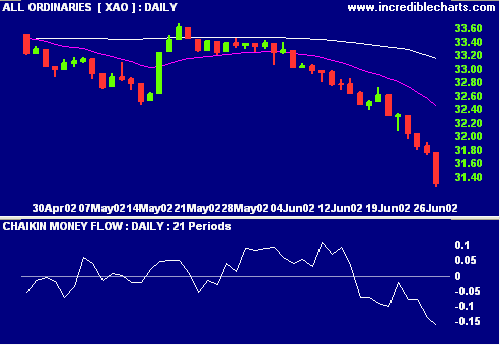

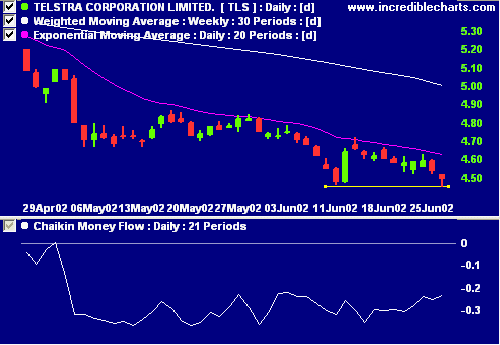

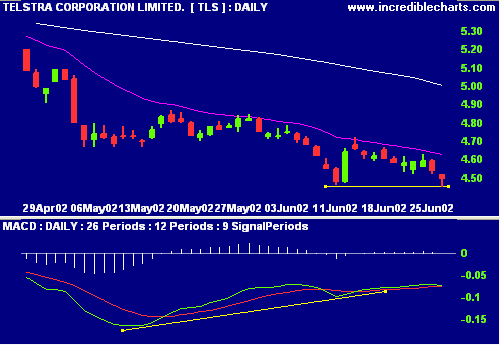

This is a bear market, with primary and secondary cycles trending down.

After a weak opening the Nasdaq Composite

rallied to close up 0.4%, above the key 1400 support level, at

1429.

The primary and secondary cycles trend downwards.

The S&P 500 also had a weak opening and

then rallied to above the key 960 support level, closing 3

points down at 973.

Primary and secondary cycles continue downwards.

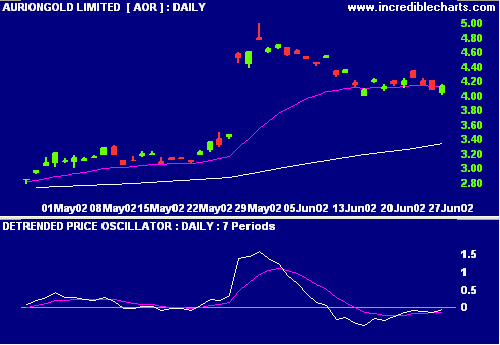

Directors of AurionGold have rejected the Placer Dome takeover bid, citing a number of factors including Placer's falling share price. (more)

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.