Trading Diary

June 25, 2002

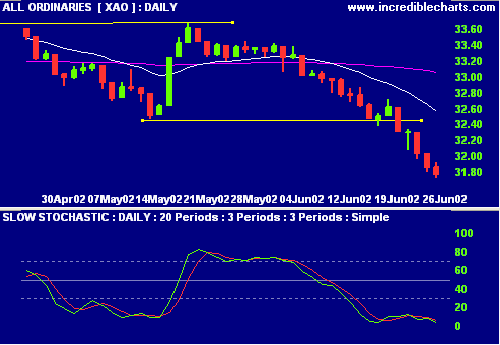

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite dropped 2.5% to close at

1423, testing September 2001 support levels.

The primary and secondary cycles trend downwards.

The S&P 500 lost 16 points to close at

976, approaching support at 960.

Primary and secondary cycles continue downwards.

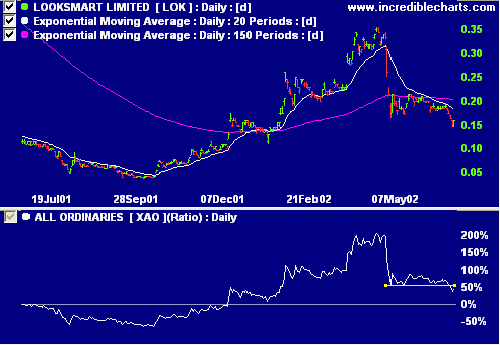

Looksmart boardroom turmoil

[LOK]

Evan Thornley steps down as CEO but remains

as Chairman, while 3 other directors quit.

(more)

MACD and Relative Strength (price ratio:

xao) are weak, while Chaikin Money Flow is positive.

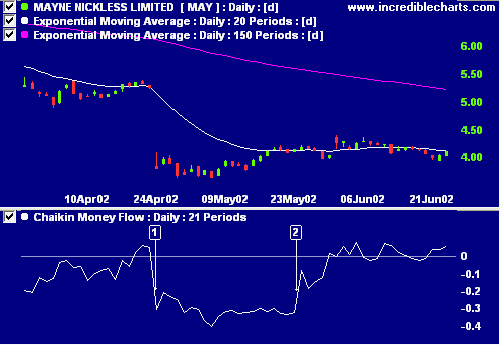

Chaikin Money Flow has one major flaw to watch out for: Note the sharp fall [1] on April 24th, when price gapped downward. 21 days later at [2], when the downward gap is dropped from the indicator window, Chaikin MF rises steeply. Indicators calculated with a simple moving average have this propensity to "bark twice" - first when the data "arrives" and later when it "leaves".

I have been working on an improvement to eliminate this flaw.

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.