Trading Diary

June 18, 2002

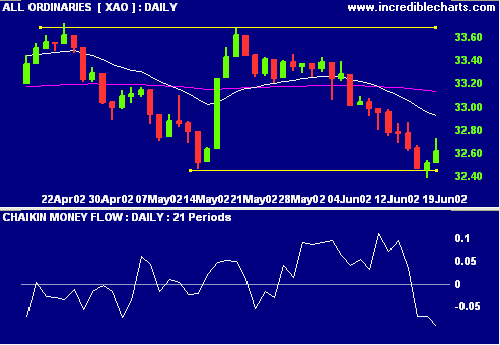

The primary bear-trend has made a faltering start, closing back above the 9500 support level. Unless the rally carries above 10400, the down-trend continues. The secondary cycle still trends downwards.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

The Nasdaq Composite closed down 10 points at

1542.

The primary cycle is in a bear trend. The short cycle has made

a higher peak but the secondary cycle is still in a

down-trend.

The S&P 500 closed up 1 point, at

1037.

Primary and secondary cycles continue to trend

downwards.

Sectors

Analysis of ASX

sectors reveals the following

stages:

Growth Sectors

-

Stage 1 possible recoveries - Technology (XMI)

-

Stage 2 bull trends - Banks & Finance (XBF) and Food & Household Goods (XFH)

-

Stage 3 possible reversals - Retail (XRE) and Transport (XTP)

-

Stage 4 bear trends - Developers (XDC), Insurance (XIN), Alcohol & Tobacco (XAT), Health & Biotech (XBH), Media (XME), Telecom (XTE) and Diversified Resources (XDR).

Cyclicals

-

Stage 2 bull trends - Gold (XGO), Paper & Packaging (XPP), Chemicals (XCE), Property Trusts (XPT) and Tourism & Leisure (XTU)

-

Stage 3 possible reversals - Building Materials (XBM), Other Metals (XOM) and Energy (XEY)

-

Stage 4 bear trends - Investment & Financial Services (XIF), Engineering (XEG), Infrastructure Utilities (XIU) and Diversified Industrial (XDI).

At the end of June the ASX will cease to provide detailed sector indices. We will endeavor to find other sources.

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.