Trading Diary

June 12, 2002

Another successful test of the 9500 - 9600 support level. A break below this level will complete a broad head and shoulders pattern and signal a primary bear-trend.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

The Nasdaq Composite rallied 1.5% to

1519.

The primary and secondary cycles trend downwards.

The S&P 500 rose 7 points to 1020.

Primary and secondary cycles trend downwards.

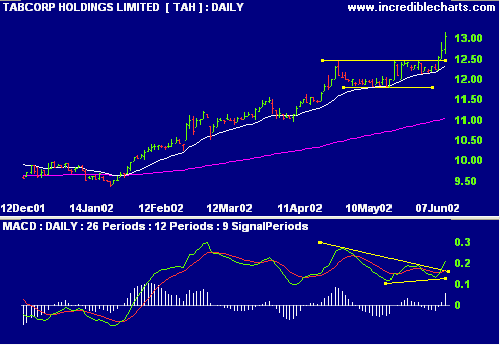

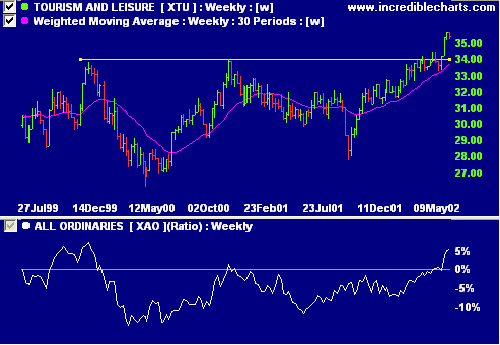

Sectors: Tourism &

Leisure

The XTU index is in the middle of a

bull trend, largely due to the Casinos & Gaming

sector.

Relative Strength (price ratio: xao), MACD and Chaikin

Money Flow are strong.

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.