Trading Diary

June 11, 2002

The average is again testing support at 9500. A break below this level will signal a primary bear-trend.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

The Nasdaq Composite fell sharply to close at

1497.

The primary and secondary cycles trend downwards.

The S&P 500 fell 17 points to close at

1013.

Primary and secondary cycles trend downwards.

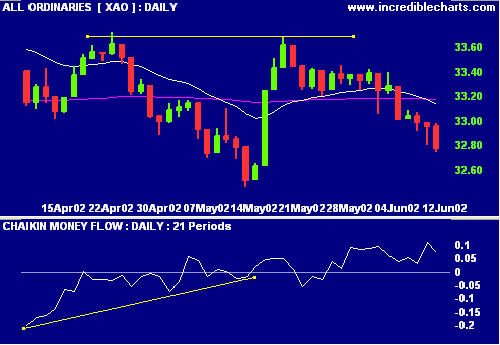

Wait for Detrended Price Oscillator and Chaikin MF signals before entering short trades.

Sectors

Analysis of ASX

sectors reveals the following

stages:

Growth Sectors

-

Stage 1 possible recoveries - Media (XME), Telecom (XTE) and Technology (XMI)

-

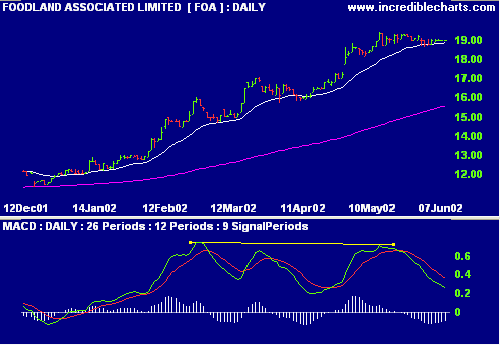

Stage 2 bull trends - Banks & Finance (XBF) [advanced]

-

Stage 3 possible reversals - Retail (XRE) and Transport (XTP)

-

Stage 4 bear trends - Developers (XDC), Insurance (XIN), Alcohol & Tobacco (XAT), Health & Biotech (XBH) and Diversified Resources (XDR).

Cyclicals

-

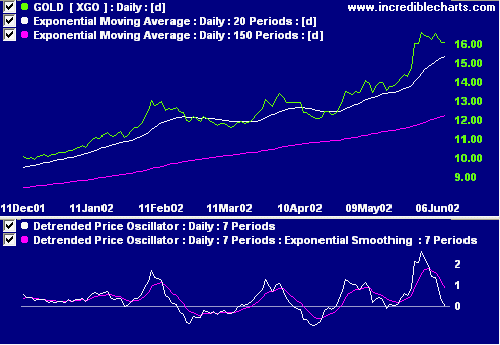

Stage 2 bull trends - Gold (XGO), Paper & Packaging (XPP) and Chemicals (XCE) [advanced]; Tourism & Leisure (XTU) [early]

-

Stage 3 possible reversals - Building Materials (XBM) and Energy (XEY)

-

Stage 4 bear trends - Engineering (XEG) and Diversified Industrial (XDI).

At the end of June the ASX will cease to provide detailed sector indices. We will endeavor to find other sources.

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.