Trading Diary

June 5, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow rallied more than 1% to 9796 on

above-average volume.

The primary trend is up, but a break below 9500 will signal a

bear-trend, while the secondary cycle trends downwards.

The Nasdaq Composite rose more than 1% to

1595.

The primary and secondary cycles continue to trend

downwards.

The S&P 500 recoverd 9 points to

1049.

The primary and secondary cycles trend downwards.

Wal-Mart sales are up

Wal-Mart reported a 6.2%

increase in May sales on a same-store basis (excluding new store

openings or closures). (more)

Service economy expanding

The Institute of Supply

Management reported that its May US non-manufacturing index

jumped to 60.1, from 55.3 in April . (more)

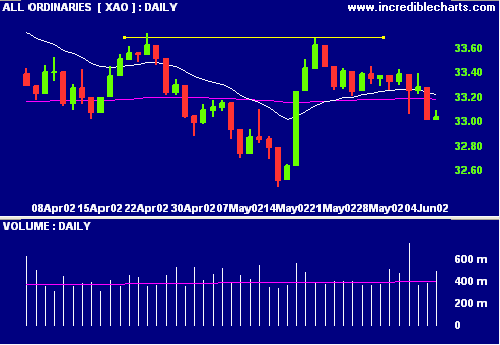

ASX Australia

The All Ords recovered by 3 points to 3004 on

strong volume.

MACD (26,12,9) and Slow Stochastic (20,3,3) are

below their signal lines.

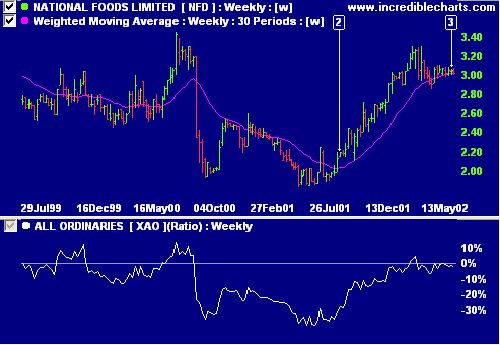

Danone buys into dairy [NFD]

French dairy group Danone pays $102 million

for 10.1 per cent of National Foods. (more)

NFD has climbed steeply over the last year

but lately seems to have leveled off, with Relative Strength

(price ratio: xao) failing to hold above zero.

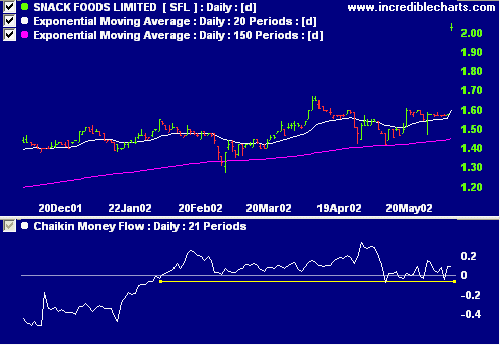

Arnotts snack [SFL]

Arnotts launched a $260

million takeover bid for Snack Foods Limited, makers of Dick

Smiths biscuits and CCs. (more)

SFL closed at $2.03. Relative Strength (price

ratio: xao) is positive while Chaikin MF has shown strong

accumulation since February.

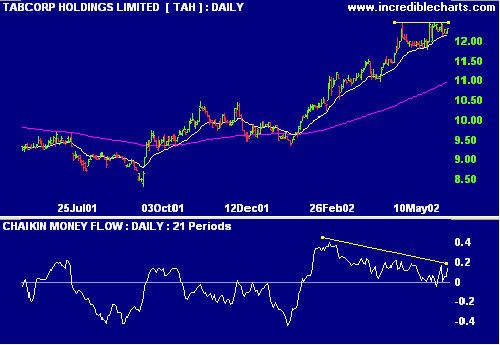

Tabcorp [TAH]

The Victorian gaming

operator remains silent on whether it is pursuing a major UK

off-course bookmaking firm. (more)

Relative Strength (price ratio: xao) is

positive and Chaikin MF shows strong accumulation over the last

4 months. MACD and Chaikin MF now show bearish divergences. A

positive signal would be a break above resistance at $12.45,

negative would be a break below support at $11.80.

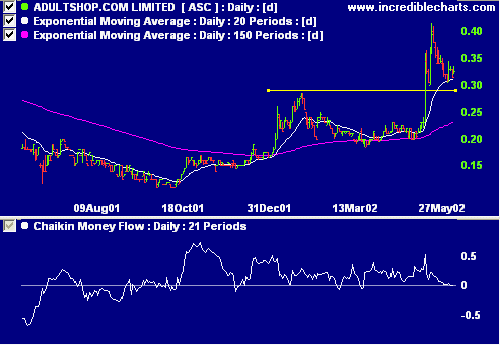

Adultshop [ASC]

ASC recently broke out above resistance at 29

cents and is about to test support at this same level. Chaikin

MF has shown strong accumulation over the last 8 months while

Relative Strength (price ratio: xao) and MACD are

strong.

Conclusion

Short-term: Avoid long. Maintain tight

stop-losses.

Medium-term: Wait for the All Ords to signal

a reversal.

Long-term: Wait for a bull-trend on the

Nasdaq or S&P 500 (primary cycle).

Colin Twiggs

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.