Trading Diary

June 3, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow fell by more than 2% to 9709 on normal

volume, showing that buyers have withdrawn from the

market.

The secondary down-trend has broken through the 9800 support

level to start a primary bear-trend.

The Nasdaq Composite dropped more than 3% to

close at 1562.

The primary and secondary trends continue downwards.

The S&P 500 made an 8-month low, falling

2.5% to close at 1040. Remember, the pattern completed on

May 6th has a target of 960.

The primary and secondary trends are down.

Tyco chief quits

Dennis Kozlowski, under

investigation for evading New York sales taxes, has quit as

chairman and CEO of the large manufacturing conglomerate.

(more)

Manufacturing index 2-year high

The Institute of Supply

Management manufacturing index rose to 55.7% in May, up from

53.9% in April. (more)

USA Interactive

The owner of the Home

Shopping Network is making a bid to become the world's

largest electronic-commerce company. (more)

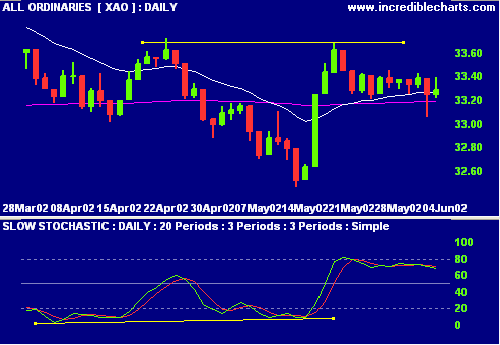

ASX Australia

The All Ords rallied, only to lose most of its

gains in an afternoon sell-off, to close at 3328 on reasonable

volume.

Chaikin Money Flow continues to signal

accumulation.

Slow Stochastic (20,3,3) is below its signal

line, MACD (26,12,9) above.

Dollar rises

The Australian dollar reached 57 US cents

for the first time in more than a year. (more)

Interest rates

An interest rate rise of up to 0.5% is

expected from the Reserve Bank meeting today. (more)

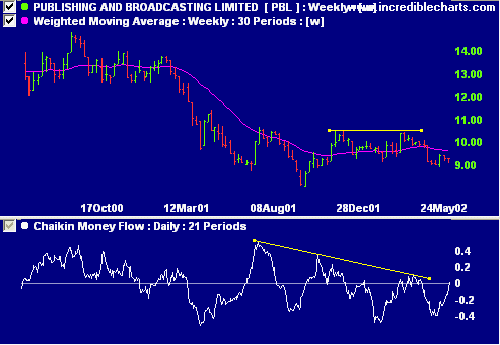

PBL axes Acxiom [PBL]

Publishing &

Broadcasting has kicked off the rationalization of its

investment portfolio with the sale of its 50% stake in Acxiom,

back to the US parent. (more)

Relative Strength (price ratio: xao) and MACD

are weak but Chaikin MF has risen impressively over the last

few weeks to cross into positive territory.

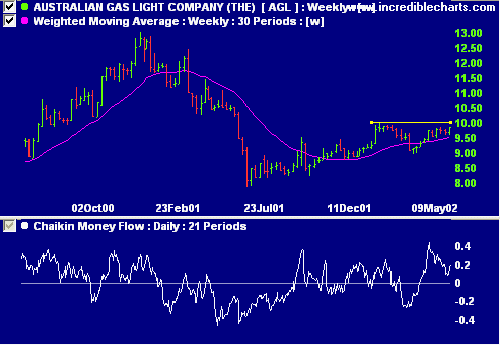

AGL [AGL]

Shareholders in The Australian Gas Light

Company will meet on 3 July to complete its conversion to a

company and lift the 5% shareholding limit imposed by its 1837

constitution. (more)

Chaikin MF shows accumulation while MACD looks

bearish. Relative Strength (price ratio: xao) is improving and

the 30-week weighted MA slopes upwards.

Conclusion

Short-term: Avoid long - Stochastic is below its

signal line. Maintain tight stop-losses.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.