Trading Diary

May 30, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow briefly tested the 9800 support level

before rallying to close only slightly down at 9911.

The secondary down-trend continues but will have to break through

the 9800 (and arguably 9500) support levels to start a primary

bear-trend.

The Nasdaq Composite rose 7 points to close

at 1631.

The primary and secondary trends are down.

The S&P 500 closed down 3 points at

1064.

The primary and secondary cycles are trending downwards.

Palm's down

The hand-held device maker

revised fourth-quarter sales forecasts down by 22% and expects to

make a loss. (more)

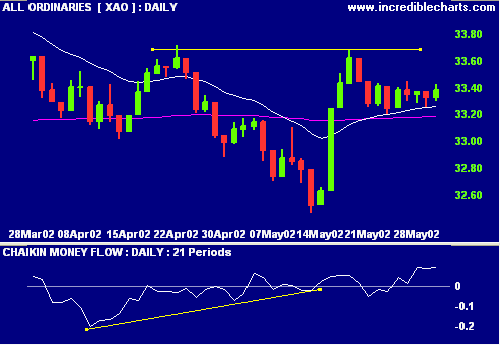

ASX Australia

The All Ords was up 6 points at 3339 on strong

volume.

Chaikin Money Flow continues to signal

accumulation.

Slow Stochastic (20,3,3) and MACD are above

their respective signal lines.

Dollar rises

The Australian dollar closed up further at

56.47 US cents. (more)

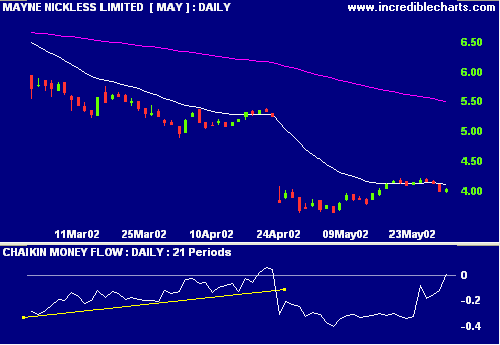

Smedley to quit Mayne [MAY]

Peter Smedley is to quit

Mayne after the spin-off of logistics division, leaving MAY to

focus on its core health operations. (more)

Relative Strength (price ratio: xao) and MACD

are weak but Chaikin MF has again crossed to positive

territory, signaling accumulation.

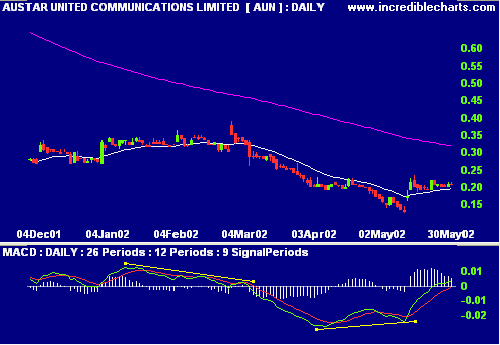

Austar [AUN]

Small shareholders revolt against the grant of

new management share options. (more)

MACD and Chaikin MF show bullish divergences

while Relative Strength (price ratio: xao) is still

neutral.

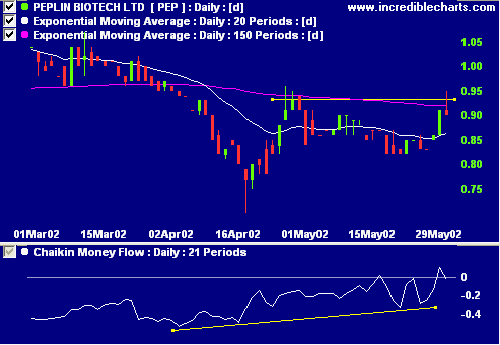

Peplin positive results [PTD]

Peplin Biotech's anti-skin cancer drug

recorded positive results against a wide range of cancers and

warrants further research, according to the American National

Cancer Institute. (more)

MACD and Chaikin MF are positive, while

Relative Strength (price ratio: xao) is still neutral.

Conclusion

Short-term: Long - Stochastic and MACD are

above their signal lines. Maintain tight stop-losses.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.