Trading Diary

May 27, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

US markets were closed for the Memorial Day

holiday.

BW Top 50

Business Week's Top 50, headed

by stalwart Johnson & Johnson, is missing a few of the former

high-fliers. (more)

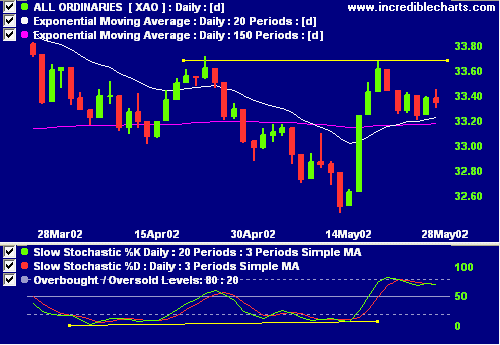

ASX Australia

The primary trend is up, secondary trend -

down.

Chaikin Money Flow is fluctuating around zero,

signaling uncertainty.

Slow Stochastic (20,3,3) has moved back below

its signal line.

The dollar

The dollar strengthened to 55.67 US cents.

(more)

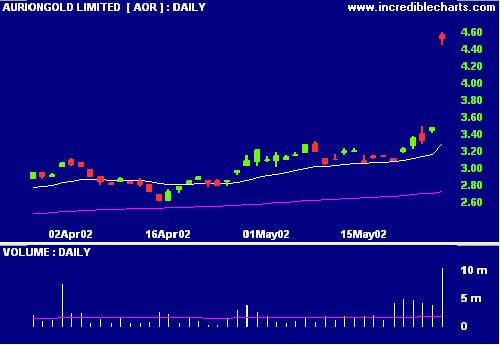

Placer Dome bids $ 2 billion for AurionGold

[AOR]

The Vancouver-based gold miner is offering

17.5 shares for every 100 AurionGold, only recently formed by

the merger of Delta Gold and Goldfields. (more)

AOR experienced a large

breakaway gap accompanied by strong volume. It is

interesting to note the increased volume over the week prior to

the announcement.

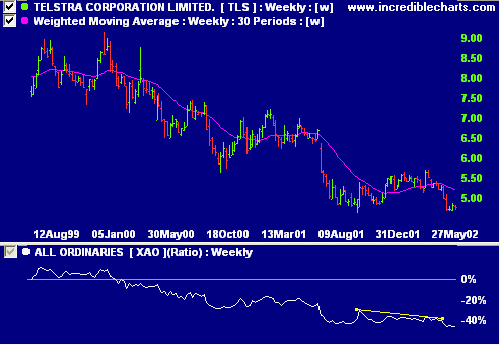

Early sale of Telstra? [TLS]

The Coalition is moving towards an early sale

of the rest of Telstra, to be put to the Senate. (more)

TLS: Relative Strength (price ratio: xao),

MACD and Chaikin MF still show weakness.

Conclusion

Short-term: Avoid new entries. Maintain tight

stop-losses.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.