Trading Diary

May 24, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow fell by more than 1% to 10104 on low

volume.

The primary trend is up, secondary - up and

short trend - down.

The Nasdaq Composite dropped more than 2% to close at

1661.

The primary cycle base is weak with the index

starting to trend downwards, the secondary and short trends are

down.

The S&P 500 closed 13 points down at

1083.

The primary cycle base is weak and starting to

trend lower, the secondary trend is down and short cycle -

up.

Memorial Day

The market will be closed on Monday.

Stocks down ahead of Memorial Day

Microsoft and Intel led stocks lower as Goldman

Sachs warns of lower semiconductor demand and the government

revises first-quarter growth estimates downwards. (more)

CMS chief quits

The CEO of CMS Energy Corp. resigns after

disclosure of $US 5.2 billion in sham electricity trades.

(more)

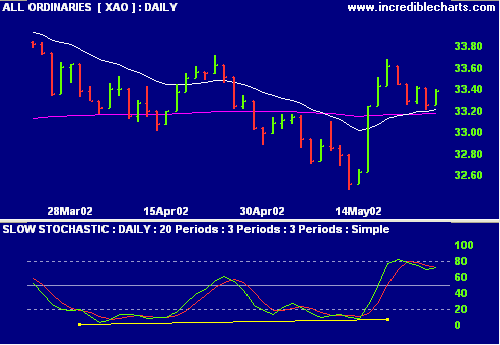

ASX Australia

Institutional buying helped the All Ords to

close up at 3338 on low volume.

The primary trend is up, secondary - down and

short trend - up.

Chaikin Money Flow fluctuates around zero,

signaling uncertainty.

Slow Stochastic (20,3,3) has joined MACD

(26,12,9) above its signal line.

The dollar

The dollar's rise may hurt exporters.

(more)

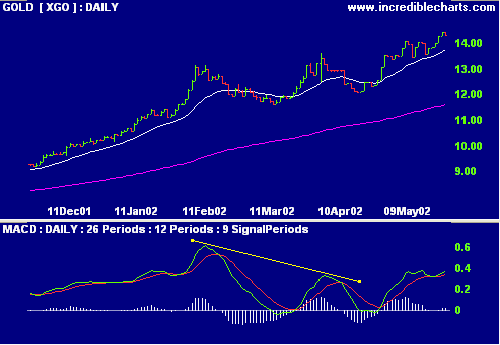

Gold bulls are back

Gold made a 30-month high this week, reaching

$US 322.5 an ounce. (more)

Chaikin Money Flow and Relative Strength

(price ratio: xao) both show strength, while MACD appears to be

recovering after a bearish divergence.

Conclusion

Short-term: Look for new entries. Maintain

tight stop-losses.

Medium-term: Wait for the All Ords to form a

base.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.