Trading Diary

May 22, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow recovered 0.5% to 10157 on normal

volume. The inside day shows uncertainty.

The primary trend is down, secondary - up and

short trend - up.

The Nasdaq Composite opened lower and then rose 0.5% to close at

1673, within yesterday's range.

The primary cycle base is weak with the index

starting to trend downwards, the secondary trend is down, while

the short trend is up.

The S&P 500 moved up by a similar amount to

close at 1086.

Primary cycle base still shows weakness,

secondary trend - down and short cycle - up.

Citigroup

The financial services giant is to buy

California thrift, Golden State Bancorp, for $US 5.8 billion in

stock and cash. (more)

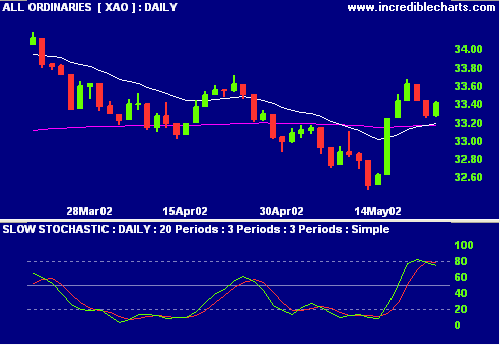

ASX Australia

The All Ords formed an inside day, closing up

12 points at 3341 on normal volume.

The primary trend is up, secondary - down and

short trend - up.

Chaikin Money Flow is still below zero,

signaling distribution.

Slow Stochastic (20,3,3) is below its signal

line.

The dollar breaks above 56 USc

The dollar traded overnight above 56 US cents

for the first time since January 2001. (more)

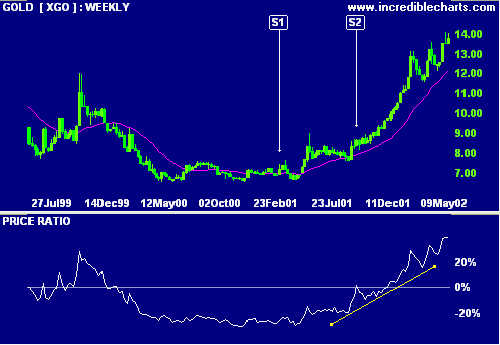

Gold

South african gold analysts see a bright

future for gold over the next 18 months. (more)

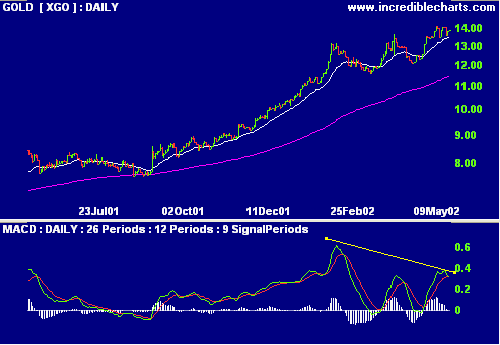

The local index continues to climb, with

strong Relative Strength (price ratio: xao) and Chaikin Money

Flow. MACD, however, shows a bearish divergence.

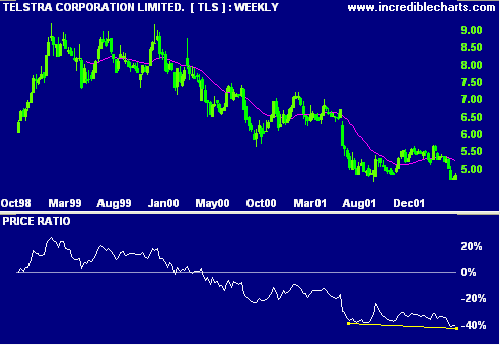

Telstra [TLS]

Telstra is signing up broadband internet clients

at an unprecedented rate. (more)

Relative Strength (price ratio: xao),

Chaikin Money Flow and MACD all show weakness.

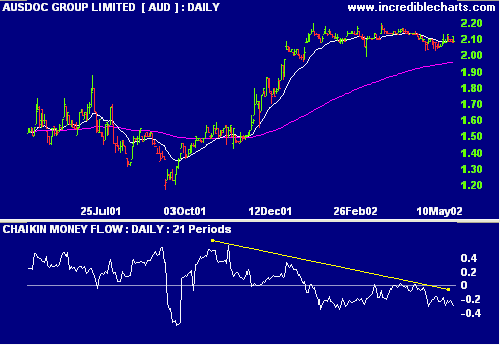

Ausdoc

The document handling company is negotiating

with a mystery $300 million-plus buyer. (more)

Chaikin Money Flow and MACD show bearish

divergences. Relative Strength (price ratio: xao) is

steady.

Conclusion

Short-term: Avoid new entries. Maintain tight

stop-losses.

Medium-term: The All Ords has not yet formed a

base.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.