Trading Diary

May 21, 2002

Software and chip stocks led the Nasdaq Composite down 2.2% to close at 1664.

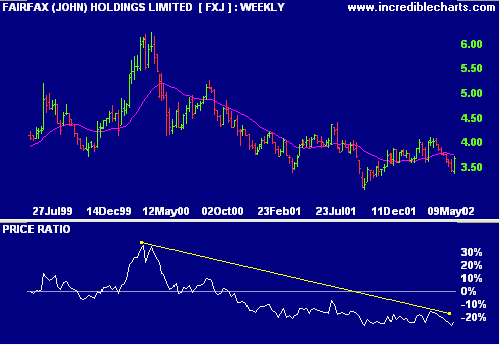

The newspaper and online publisher is expected to announce a major restructuring, as early as next week. (more)

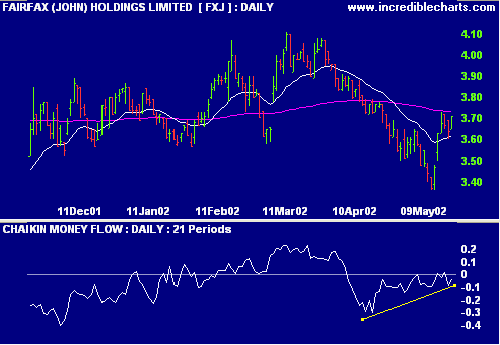

FXJ shows a bullish divergence on Chaikin Money Flow, while Price Ratio still looks weak.

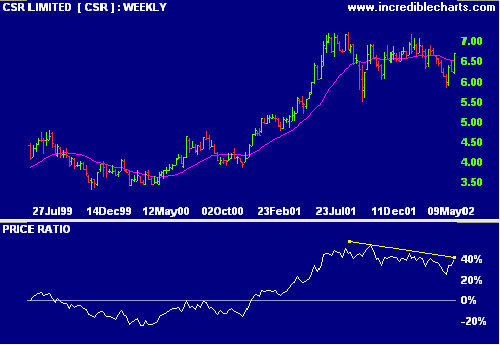

Price Ratio and the 30-week weighted moving average show a stage 3 top - and the possible start of a stage 4 decline.

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.