Trading Diary

May 16, 2002

The Nasdaq Composite formed an inside day, with a slight gain to 1730.

Dell Computers

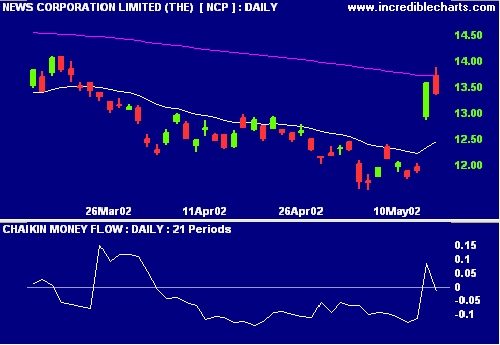

NewsCorp [NCP]

Vivendi threatens to withdraw from the purchase of NewsCorp

pay-TV assets in Italy. (more)

NCP

climbed in the morning session before retreating to close 19

cents down on strong volume.

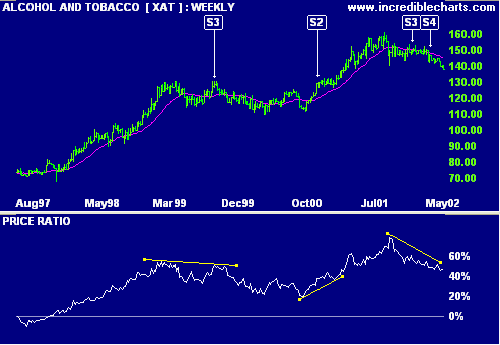

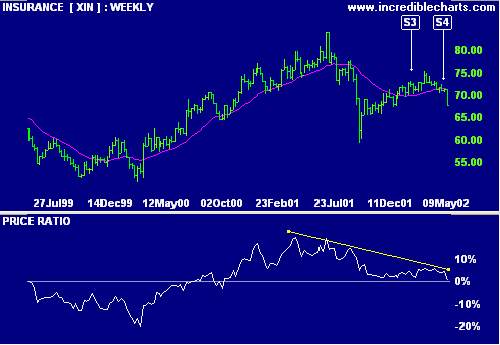

Relative strength (price ratio: XAO) is increasing but the sector index (XAT) shows a stage 4 decline.

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.