Trading Diary

May 14, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow rallied a further 1.8% to 10298 on

strong volume.

The Nasdaq Composite rallied 4% to 1719, still in a secondary

cycle down-trend.

The S&P 500 rose more than 2% to 1097, still

in a secondary cycle down-trend.

Retail Sales up 1.2%

April retail sales were up 1.2% on last year,

largely due to Easter starting in March this year - something the

market seemed to ignore. (more)

Wal-Mart

First-quarter earnings for the

world's largest retailer jumped 15% compared to last year, while

same-store sales rose 8.1%. (more)

Applied materials

Chip equipment maker Applied

Materials earned 3 cents per share in the second quarter

compared to 21 cents last year, while sales were down 46%.

Performance is up on the last quarter. (more)

ASX Australia

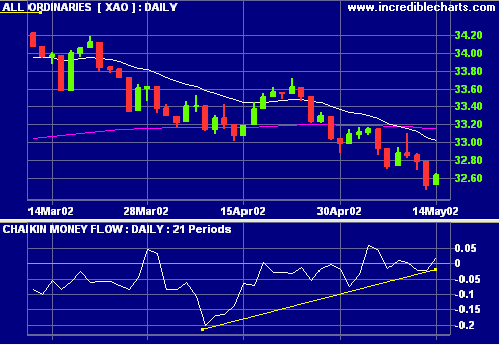

The All Ords appears unconvinced by the US

rally, forming an inside day with a close at 3263 on normal

volume.

Chaikin Money Flow continues to show a bullish

divergence while most other indicators are bearish.

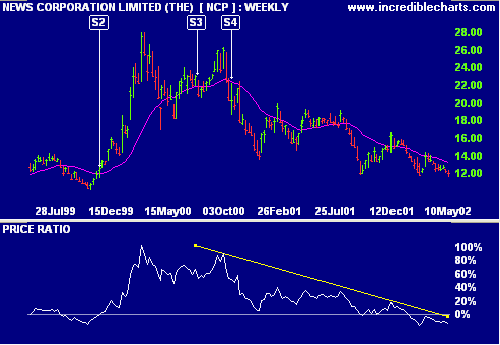

NewsCorp [NCP]

News Corporation Limited writes down its investment in US-based

Gemstar TV guide by $7.7 billion. (more)

NCP is

in a stage 4 decline, having under-performed the market since

October 2000.

More of the same

There were no major surprises

in the federal budget delivered by treasurer Peter Costello,

although healthcare may be affected by cuts to the

Pharmaceuticals Benefits Scheme. (more)

BHP Steel [BSL]

Investors in the spin-off are

to be compensated for volatility of steel prices by a high

dividend yield and a possible early capital return.

(more)

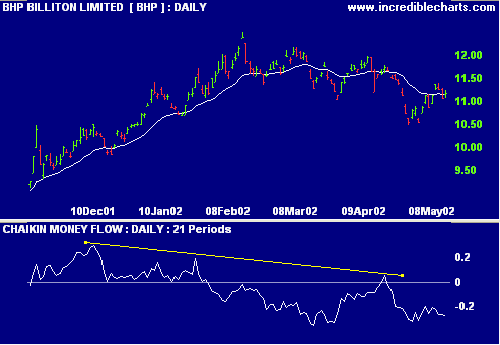

BHP: MACD and Chaikin Money Flow have both been

bearish for the last 4 months.

Conclusion

Short-term: Avoid long.

Medium-term: Wait for the All Ords to form a

base.

Long-term: Wait for the Nasdaq or S&P 500 to

form a base.

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.