Trading Diary

May 7, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow formed an inside day on large volume,

signaling uncertainty, and closed up slightly at 9836. The

secondary cycle up-trend is still intact.

The Nasdaq Composite index eased to 1573. The secondary cycle is

in a down-trend.

The S&P 500 closed down 0.3% at 1049. The

downward break has a calculated target of 960.

Fed leaves rates unchanged

As expected, the Fed left the federal funds rate

unchanged at 1.75%. (more)

Cisco rebound

Cisco Systems reported third-quarter earnings

above analysts estimates, on sales in line with

expectations. (more)

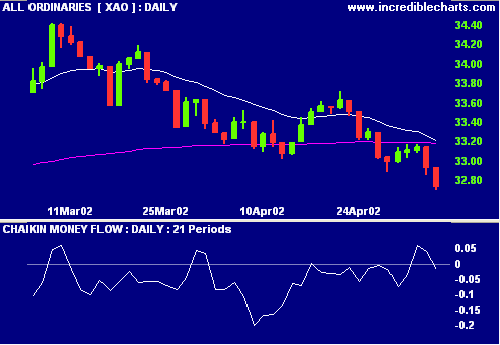

ASX Australia

The All Ords fell a further 20 points to 3274

on large volume. The target for the correction is 3230 to

3240.

Slow Stochastic and MACD are below their signal

lines, Chaikin Money Flow signals distribution.

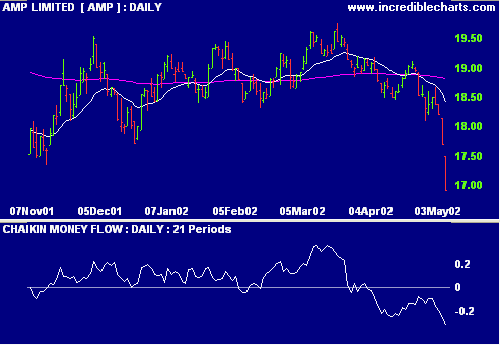

AMP [AMP]

The insurer is under pressure because of an

outflow in its funds management operations. (more)

Chaikin Money Flow switched from accumulation

to distribution in early April, following a bearish divergence

on MACD.

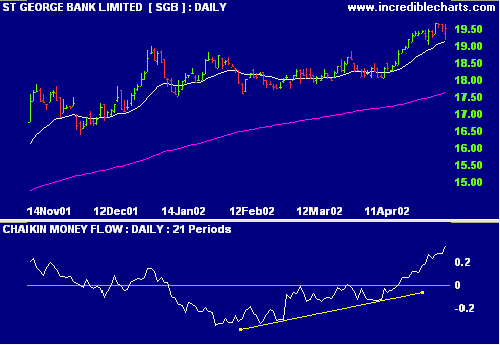

St George [SGB]

The regional bank raised its first-half

operating profit by 41%, before write-downs relating to

Wealthpoint. (more)

Chaikin Money Flow shows strong accumulation in

April, while MACD shows some weakness.

Conclusion

Short-term: Avoid long.

Medium-term: Wait for the All Ords to form a base, expected

around 3230.

Long-term: Wait for the Nasdaq or S&P 500 to form a base.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.