Trading Diary

May 6, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow fell sharply, closing almost 2% down at

9808 on normal volume. The secondary cycle up-trend is still

intact.

The Nasdaq Composite index dropped more than 2% to close at 1578.

The secondary cycle is in a down-trend.

The S&P 500 fell through the 1070 support

level, closing 1.9% down at 1052. The break below the support

level has a calculated target of 960 - close to September 2001

levels.

Stocks tumble, interest rates unlikely to

change

With the fall in stock prices, the Fed is

expected to leave interest rates unchanged at its meeting

tomorrow. (more)

The sage of Omaha

Warren Buffett speaks on the terrorism threat

facing the insurance industry. (more)

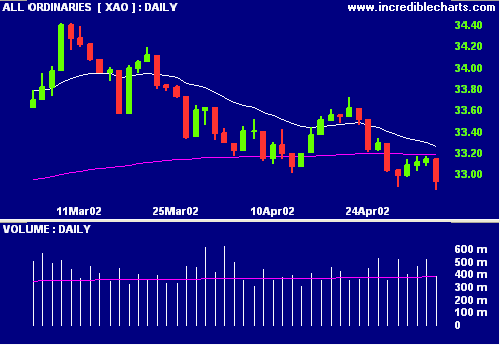

ASX Australia

The All Ords fell below 3300 as buyers withdrew

from the market, closing at 3294 on normal volume.

Slow Stochastic has joined MACD below its

signal line.

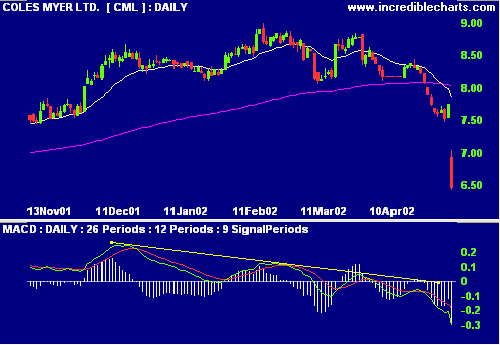

Right when? [CML]

Coles Myer's Right Now profitability

campaign misfires as the retailer issues a profit

warning. (more)

MACD shows a bearish divergence since

February 2002.

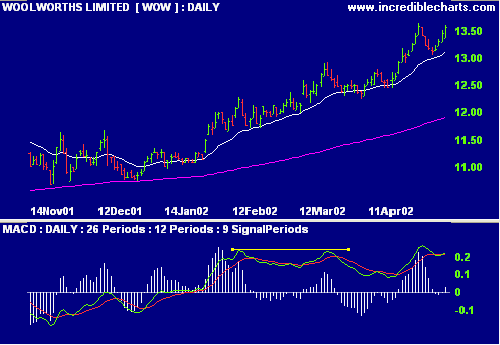

Sectors: Retail

Competitor Woolworths has continued to make

gains, despite a weak bearish divergence on MACD.

Conclusion

Short-term: Avoid long. Keep stop losses on existing trades as

tight as possible.

Medium-term: Wait for the All Ords to form a base.

Long-term: Wait for the Nasdaq or S&P 500 to break above

their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.