Trading Diary

May 3, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow is back down at the 10000 level, closing

at 10006 on normal volume. The secondary cycle up-trend is

still intact.

The Nasdaq Composite index managed a more spectacular 1.9% fall,

to close at 1613. The secondary cycle is in a down-trend.

The S&P 500 again tested the 1070 support

level, closing at 1703. A break below the support level has a

calculated target of 960.

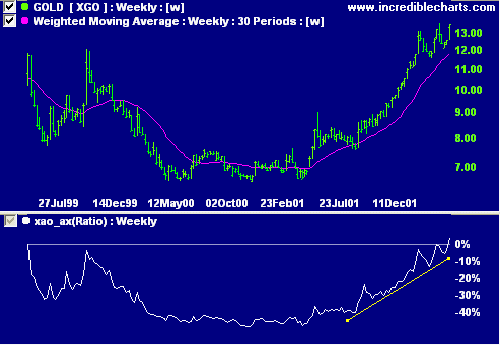

Gold is gaining strength

Gold shares are already discounting higher gold

prices and may be out-performed by gold

bullion. (more)

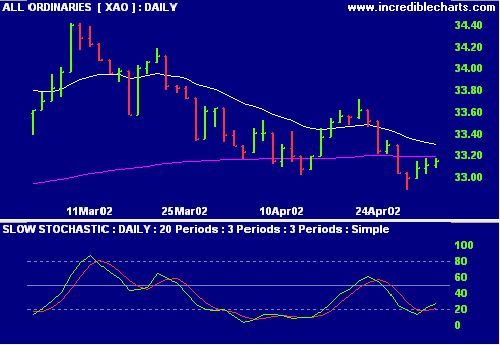

ASX Australia

The All Ords gained slightly, closing above the

3300 support level, at 3315 on strong volume.

Chaikin Money Flow has moved to above zero and

the Slow Stochastic above its signal line, but it is too early to

call this a market bottom.

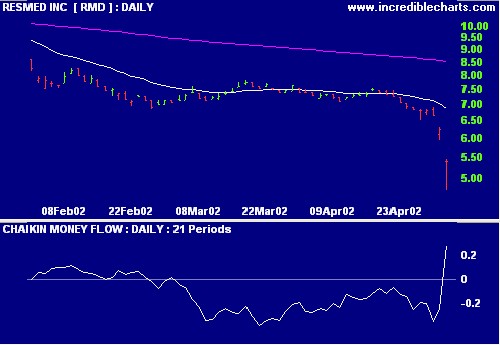

ResMed in need of resuscitation [RMD]

RMD recorded strong growth in sales and

earnings but warn of difficulty meeting forecasts for the

fourth-quarter. (more)

The stock fell as low as $4.73 before

rallying to $5.40. The sharp increase in Chaikin Money Flow

should not be interpreted as a buy signal.

Interest rates

Strong retail sales may precipitate an

interest rate rise. (more)

Sectors: Gold

The gold index XGO continues to rise, with

relative strength (price ratio: all ords) improving.

Conclusion

Short-term: Avoid long. Keep stop losses on existing trades as

tight as possible.

Medium-term: Wait for the All Ords to form a base.

Long-term: Wait for the Nasdaq or S&P 500 to break above

their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.