Trading Diary

May 2, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow managed to eke out a small gain, closing

at 10091on regular volume. The short-trend is down but the

secondary cycle up-trend is intact.

Led by a falling Microsoft, the Nasdaq Composite index dropped

almost 2% to close at 1644. The secondary cycle is still in a

down-trend.

The S&P 500 closed almost unchanged at 1084,

above the key 1070 support level. A break below 1070 has a

calculated target of 960.

No bounce

"Earnings are not going to bounce back anything

like what we need to support current valuation levels,'' says Bob

Morris, chief investment officer at Lord, Abbett &

Co. (more)

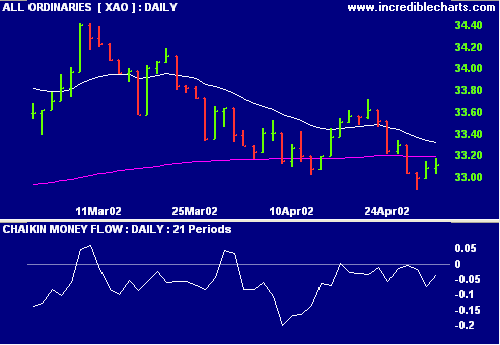

ASX Australia

The All Ords closed up slightly at 3311 on

strong volume, above the 3300 support level.

Chaikin Money Flow remains below zero, signaling

distribution.

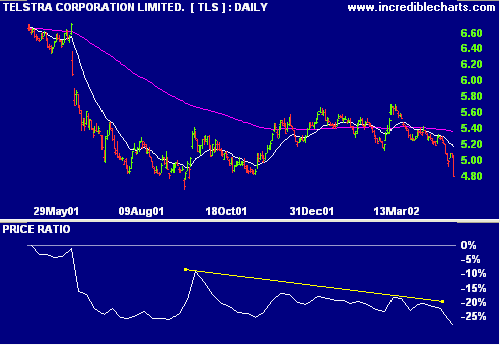

Telstra [TLS]

TLS dropped 23 cents on disappointing sales

for the March quarter. (more)

Relative strength (price ratio: All Ords),

Chaikin MF and MACD are all weakening.

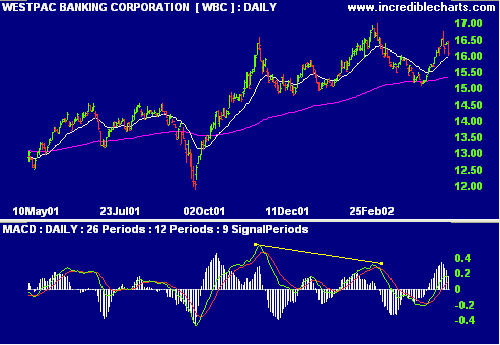

Westpac [WBC]

A 10% rise in net profit, to more than $ 1

billion for the half-year, but WBC still weakens. (more)

MACD showed a bearish divergence in

February/March, while Chaikin MF and Relative strength still

look positive.

Conclusion

Short-term: Avoid long. Keep stop losses on existing trades as

tight as possible.

Medium-term: Wait for the All Ords to form a base.

Long-term: Wait for the Nasdaq or S&P 500 to break above

their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.