Trading Diary

April 26, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow dropped more than 1% to close at 9910

on normal volume, closing below the 10000 level for the first

time in 2 months. The short-trend is down but the secondary

cycle up-trend is still intact.

The Nasdaq Composite index closed down almost 3% at 1663. The

break below the 1700 support level signals the start of a

down-trend on the secondary cycle.

The S&P 500 fell 1.4% to close at 1076,

testing the 1070 support level.

GDP grows by 5.8%

The economy grew at 5.8% in the first quarter,

the highest rate in 2 years. (more)

Market concerns

Despite strong GDP growth, the market has

been undermined by a slew of profit warnings, corporate

accounting worries, declining consumer confidence and

tensions in the Middle East. (more)

Verisign

The website registration and online security

stock fell 46% after cutting sales forecasts for the second

quarter. (more)

ASX Australia

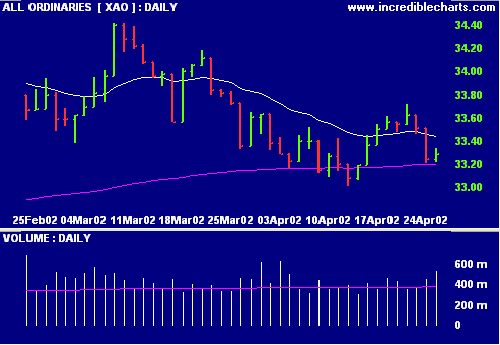

The All Ords formed an inside day on strong

volume, signaling uncertainty, closing at 3329.

ANZ reaches $1 billion [ANZ]

ANZ reported a first-half

profit of $1.05 billion, 17% above the corresponding period

last year. (more)

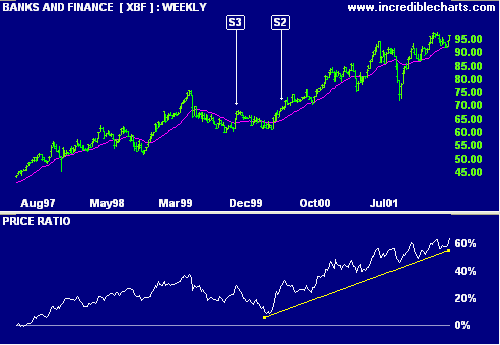

Banks see funds management as major growth

opportunity

Banks have proved unsuccessful at growing

their own fund management businesses so they are buying up

fund managers. (more)

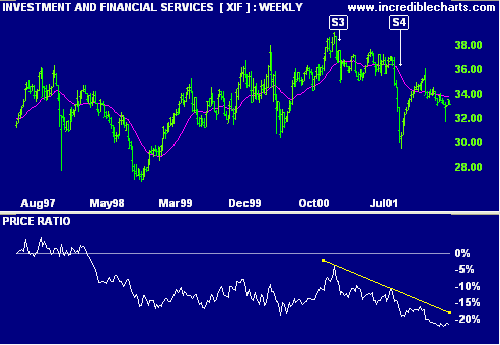

This is not a bad time to buy: the banks

index (XBF) is in a strong up-trend while the investment

& financial services sector (XIF) is weak and suffering

from September 11 fallout.

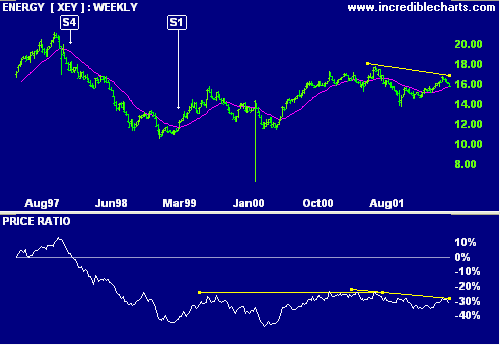

Sectors: Energy

The Energy index is showing signs of

weakening, with declining relative strength (price ratio).

Mobil and Caltex have both reported losses on refining and

marketing operations.

Conclusion

Short-term: Avoid long. Keep stop losses on

existing trades as tight as possible.

Medium-term: Wait for the All Ords to bottom

out - the double top has a target of 3230 to 3240.

Long-term: Wait for the Nasdaq or S&P 500

to break above their January highs.

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.