Trading Diary

April 24, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow weakened further, closing at 10030 on

reasonable volume. The short-trend is down but the secondary

cycle up-trend is intact.

The Nasdaq Composite index closed 1% down at 1713, signaling an

intermediate down-trend. A break below the 1700 support level

will signal a down-trend on the secondary cycle.

The S&P 500 followed a similar pattern,

closing lower at 1093, approaching the 1070 support

level.

AOL write-off "the biggest in history"

AOL was forced to write-down its investment in

Time-Warner by $US 54.2 billion, reflecting the fall in market

value of its assets. At least they paid in "funny money", one

fund manager observed. (more)

AT&T

The telecom giant lost nearly $US 1 billion

in the first quarter. (more)

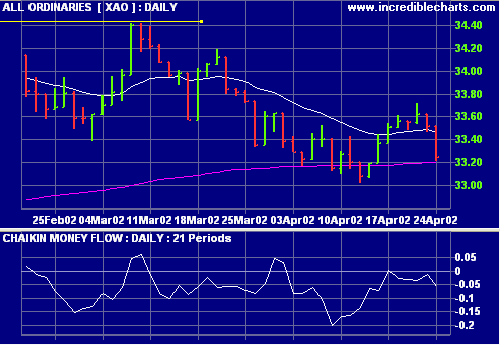

ASX Australia

The All Ords dropped sharply to close at 3324

on strong volume.

Chaikin Money Flow declined further, signaling

continued distribution.

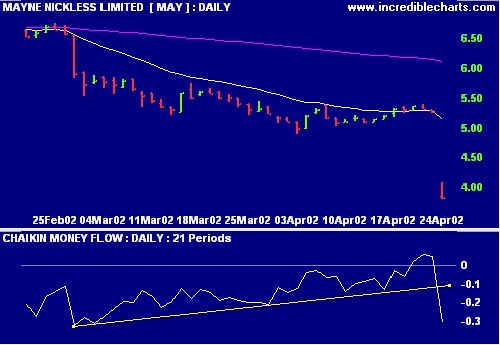

Mayne under the knife [MAY]

Analysts cut their

recommendations on Mayne Group Ltd after their earnings

downgrade - the third in a row. (more)

There was strong distribution - Chaikin Money

Flow plummeted, with Volume more than 10 times the

average.

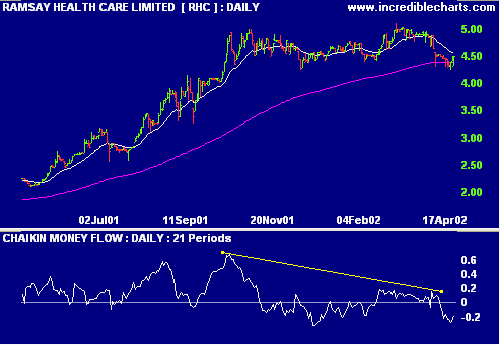

Competitor, Ramsay Health Care [RHC] moved

slightly higher on the day, after confirming that it would meet

earnings estimates, but the longer term picture is also weak

with a bearish divergence on Chaikin Money Flow.

Conclusion

Short-term: Avoid long. Keep stop losses on

existing trades as tight as possible.

Medium-term: Wait for the All Ords to bottom

out - the double top has a target of 3230 to 3240.

Long-term: Wait for the Nasdaq or S&P 500

to break above their January highs.

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.