Trading Diary

April 23, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow formed an inside day, falling 0.5% to

10089 on reasonable volume. The short-trend is down but the

secondary cycle up-trend is intact.

The Nasdaq Composite index fell 1.6% to close at 1730, testing

support at 1725. The index is still above the major 1700

support level, with resistance at 1950.

The S&P 500 moved lower, to close at 1100,

within the 1070 to 1180 trading range.

Exxon Mobil

Recently dethroned as the world's largest

company, first-quarter earnings fell to $US 2.15 billion from

$US5.05 billion a year earlier. (more)

Du Pont

The largest chemical company in the US

missed analysts first-quarter estimates while sales fell

12%. (more)

Amazon

The online store narrows its first-quarter

loss as sales rise 21%. (more)

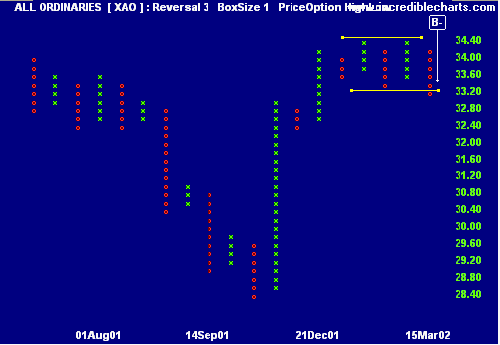

ASX Australia

The All Ords closed down at 3352 on weak

volume.

Chaikin Money Flow continues in negative

territory, signaling that distribution is taking

place.

The Point and Figure chart (High-Low price)

has completed a double top, breaking below support [B-] at the

neckline.

Dollar at 54 US cents

The dollar is hovering at around 54 US cents

but is expected to slip back to 53 US cents. (more)

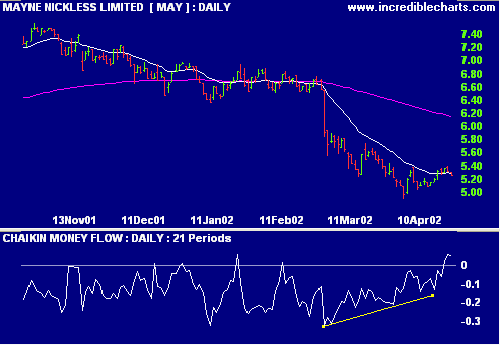

Mayne needs medical attention [MAY]

The healthcare and logistics

group warned that it will miss analysts' forecasts by as much

as 18%. (more)

The market has shown its faith in Peter

Smedley with Chaikin Money Flow signaling strong accumulation

over the last month.

The sector, Health & Related Products,

includes a number of outperforming stocks: SDI Limited (SDI),

Ellex Medical Lasers (ELX) and Micromedical Industries

(MMD).

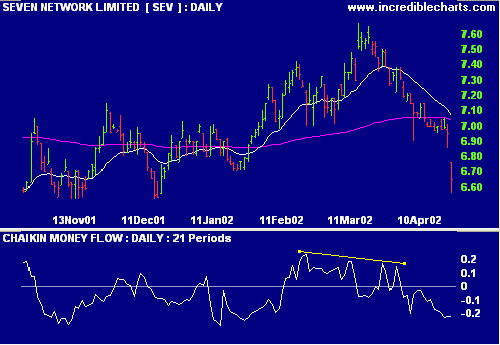

Seven falls [SEV]

Seven Network stock falls as

ratings decline by 11% since the start of the year.

(more)

Note the bearish divergence on Chaikin Money

Flow in March 2002.

Conclusion

Short-term: Avoid long. Keep stop losses on

existing trades as tight as possible.

Medium-term: Wait for a new high on the All

Ords.

Long-term: Wait for the Nasdaq or S&P 500

to break above their January highs.

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Access the Trading Diary Archives.