Trading Diary

April 22, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow fell more than 1% to 10136 on lower

volume. The short-trend is down but the secondary cycle

up-trend is intact.

The Nasdaq Composite index opened up a gap to close more than

2% weaker at 1758 - still above support at 1700, with

resistance at 1950.

The S&P 500 closed down 1.5% at 1107,

within the 1070 to 1180 trading range.

The lines are down

Investors flee telecom stocks as WorldCom cuts

revenue and cash flow targets, Ericsson is to lay off one-fifth

of its work force and Lucent cuts 7000 jobs. (more)

Gold at $355 an ounce?

Analysts are bullish on the outlook for

gold. (more)

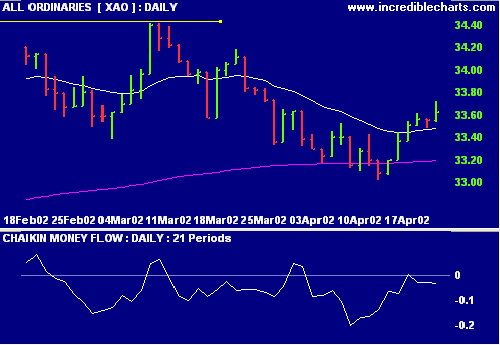

ASX Australia

The All Ords closed up at 3362 on lower

volume. The weak close signals that the market may face

increased selling pressure. Chaikin Money Flow continues in

negative territory, signaling that distribution is taking

place. The MACD remained positive while the Slow Stochastic

crossed below its signal line.

Dollar at 54 US cents

The dollar is hovering at around 54 US cents

but is expected to slip back to 53 US cents. (more)

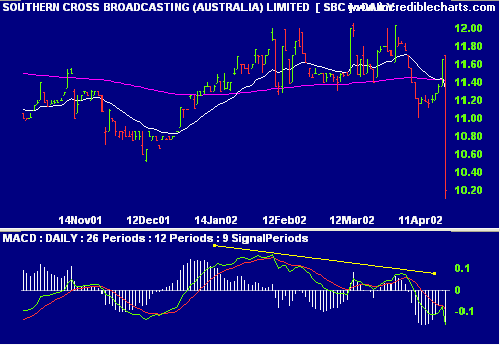

Southern Cross Broadcasting [SBC]

Stock in the media company fell 12% as it

failed to meet analysts forecasts and warns that there are no

signs of improvement in the advertising market.

SBC has been showing a bearish MACD

divergence for several weeks.

Conclusion

Short-term: Avoid new entries. Keep stop losses on existing

trades as tight as possible.

Medium-term: Wait for a new high on the All Ords.

Long-term: Wait for the Nasdaq or S&P 500 to break above

their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.