Trading Diary

April 18, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow closed down slightly at 10205 on

strong volume but closed near the day's high, showing that

buyers are regaining control. The up-trend on the secondary

cycle is still intact.

The Nasdaq Composite index closed down at 1802. Support is at

1700 and resistance at 1950.

The S&P 500 had a similar day to the Dow,

closing down slightly at 1124 but with a strong close. The

index is still within the 1070 to 1180 trading

range.

Microsoft misses targets

Microsoft missed third-quarter sales and

earnings targets and warns that it will miss analysts estimates

for the year ahead, causing the stock to fall sharply in

after-hours trading. (more)

American Express

Cost-cutting helped Amex record a 15%

increase in first-quarter earnings. (more)

ASX Australia

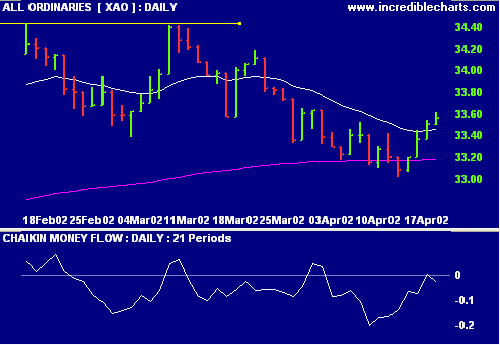

The All Ords closed up slightly at 3356 on

strong volume. A weak close saw the Chaikin Money Flow return

to negative territory while the MACD and Slow Stochastic remain

positive.

Amcor [AMC]

Acquisitions in Europe and North America

helped the packaging giant lift March-quarter earnings by

17.5%. (more)

Optus faces further cuts [SGT]

Further staff cuts are expected as revenue

falls. (more)

Conclusion

Short-term: Look for new entries. Keep stop

losses tight.

Medium-term: Wait for a new high on the All

Ords.

Long-term: Wait for the Nasdaq or S&P 500

to break above their January highs.

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.