Trading Diary

March 26, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow recovered by 0.7% to close at 10354

on reasonable volume.

The Nasdaq Composite index rallied by a similar amount to close

at 1824.

The S&P 500, likewise, rose to 1138.

SEC gets tough over accounting practices

The SEC is sueing 6 former Waste Management executives for

fraudulently inflating profits by $1.7 billion over a 5 year

period.

(more)

Network Associates

Tech stock Network Associates fell 11%

on news that the SEC is investigating its accounting practices.

(more)

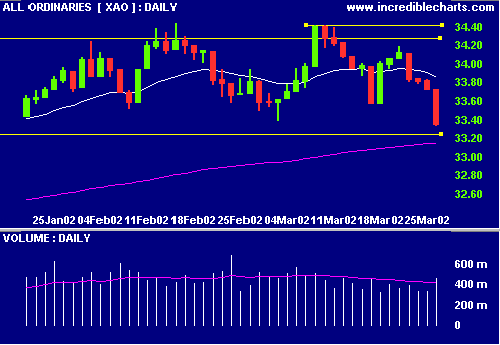

Australia - ASX

The All Ords fell sharply, closing more than 1% down on higher

volume. The MACD and Slow Stochastic are below their

signal lines.

Stocks hit by rate fears

The neutral bias from the US Fed and the 0.25% rate hike across

the Tasman has pushed the market into bear

territory.

(more)

Coles Myer [CML]

Coles are to phase out

their discount card. (more)

Sectors: Retail

The retail sector index (XRE) has been in a strong Stage 2

up-trend since August 2000, with rising relative strength

(price ratio) and rising 30-week weighted moving average.

Conclusion

Short-term: Avoid new long and tighten

up stops.

Medium-term: Wait for a new high on the All Ords.

Long-term: Wait for a secondary cycle reversal on the

Nasdaq or S&P 500 - if they break above their January

highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.