Trading Diary

March 15, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found

atTerms

of Use .

USA

The Dow climbed to 10607 on very high volume that is often

associated with a triple-witching Friday.

The Nasdaq Composite index rallied to 1868.

The S&P 500 recovered to 1166 and is likely to

test resistance at 1170 - 1180 in the days

ahead.

Adspend set to recover

UBS analyst predicts that advertising revenues will recover in

2002 - good news for media stocks which have been severely

affected by the advertising recession.

(more)

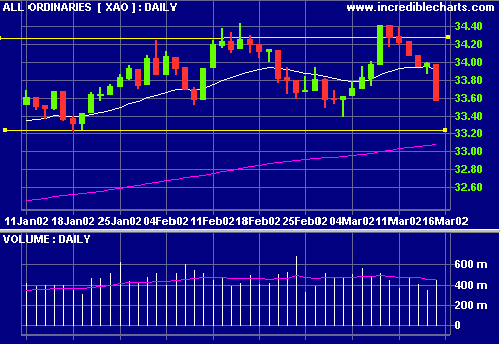

Australia - ASX

The All Ords fell sharply during the last few minutes of

triple-witching hour and a further 12 points in

the 10 minutes after the close - the settlement period

when our stops cannot be activated!! The final close was

almost 1% down at 3357 on surprisingly normal volume. The MACD

and Slow Stochastic are below their signal lines.

Harvey Norman [HVN]

The retailer posted a half-year net profit of $68 million, up

almost 20%, with strong sales of entertainment

goods.

(more)

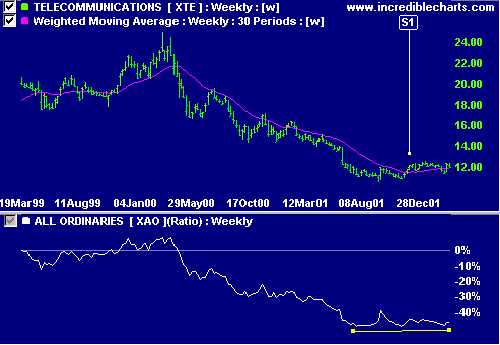

Sectors: Telecommunications

XTE is forming a solid Stage 1 base so keep an eye on those

Telstra stocks.

Conclusion

Short-term: Avoid new positions until there are signs of a

recovery.

Medium-term: No new entries until the All Ords makes

a new high.

Long-term: Wait to see if the S&P 500 breaks above its

January high.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.