Trading Diary

March 14, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found

atTerms

of Use .

USA

The Dow formed a very small inside day, closing up

slightly at 10517 on low volume. The bears are likely to

test the 10300 support level in the days ahead.

The Nasdaq Composite index closed down 0.4% at 1854.

The S&P 500 also recorded an inside day, closing almost

unchanged at 1153.

Beware of Japanese stocks

Uninformed analysts have been recommending Japan as a recovery

play.

(more)

Boeing

Accounting changes will add another $1.2 billion of debt to the

balance sheet.

(more)

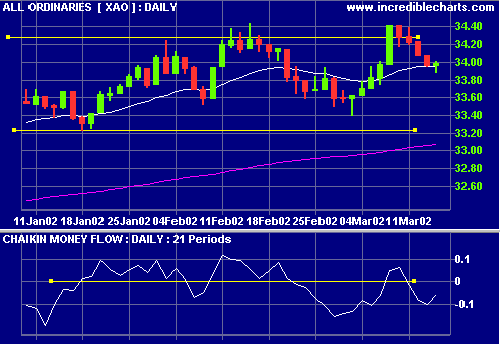

Australia

The All Ords closed slightly up at 3398 on low

volume. The Slow Stochastic is below its signal line.

Coles Myer [CML]

First-half profits rose 8.2% but the good news is

that costs are forecast to fall by $300 million

within 2 years.

(more)

Sectors: Alcohol and Tobacco [XAT]

XAT has entered a

Stage

3 trading range: the 30-week weighted moving average is

sloping down and relative strength (price ratio) has been

falling since October 2001.

Conclusion

Short-term: Avoid new positions until the Slow Stochastic turns

above its signal line.

Medium-term: Wait for a new high on the All Ords.

Long-term: Look for a secondary cycle reversal on the Nasdaq or

S&P 500 - if they break above their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.