Trading Diary

March 11, 2002

These extracts from my daily stock trading

diary are intended to illustrate the techniques used in

short-term share trading and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms of Use .

USA

The Dow formed another inside day but continues to hold above

the 10300 support level, closing up at 10611 on low

volume.

The Nasdaq Composite index formed an outside day, closing down

slightly at 1929.

The S&P 500 is encountering resistance around the level of

its January peak, closing at 1168.

IBM blues

The Big Blue has been downgraded by Sanford Bernstein.

(more)

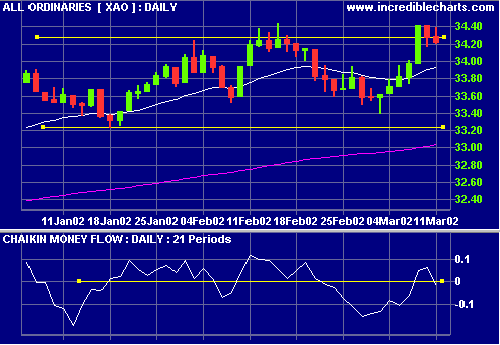

Australia - ASX

The All Ords closed below its support level at 3422 on low

volume. The MACD and Slow Stochastic are above their signal

lines.

Banks defend credit card fees

The banking industry aggressively defends credit card

interchange fees - under review by the Reserve

Bank.

(more)

ERG: Sydnet Transport legal battle and funding for future

contracts are concerns [ERG]

"Should a material number of these initiatives fail to be

completed on a timely basis, a condition of significant

uncertainty as to the going-concern status may arise. The

directors do not believe at this date that the initiatives will

not be completed on a timely basis."

(more)

Conclusion

Short-term: Avoid new positions until we see a rally. The Slow

Stochastic has been slow to turn below the signal line.

Medium-term: Wait for a new high on the All Ords.

Long-term: Look for a secondary cycle reversal on the Nasdaq or

S&P 500 - if they break above their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.