Trading Diary

March 7, 2002

These extracts from my daily

stock trading diary are intended to illustrate the techniques

used in short-term share trading and should not be interpreted

as investment advice. Full terms and conditions can be found

at

Terms of Use .

USA

The Dow formed another inside day closing down

at 10525 on reasonable volume.

The Nasdaq Composite index closed slightly down at 1881.

Greenspan confirms recession

over

"The recent evidence increasingly suggests that an economic

expansion is already well under way, although an array of

influences unique to this business cycle seems likely to

moderate its speed," Federal Reserve Chairman Allan

Greenspan tells the Senate Banking Committee.

Australia - ASX

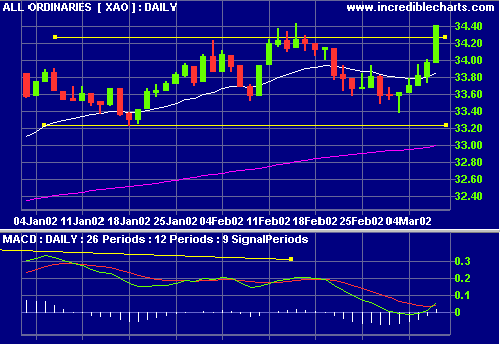

The All Ords rose steeply to make a record close at 3440 on

strong volume. The MACD has joined the Slow Stochastic

above its' signal line.

Big jump in real GDP

GDP for the December quarter jumped 1.3%, almost twice the

figure expected.

(more)

The All Ords record close

The All Ords closed at 3440, just failing to exceed the high of

3443.9 reached last month.

(more)

Conclusion

Short-term: The MACD joins the Slow Stochastic above its signal

line. Take new positions but keep tight stops as we can expect

a retest of support levels in the next week.

Medium-term: Wait for a new high on the All Ords.

Long-term: Look for a secondary cycle reversal on the Nasdaq or

S&P 500 - if they break above their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.