Trading Diary

March 4, 2002

These extracts from my daily

stock trading diary are intended to illustrate the techniques

used in short-term share trading and should not be interpreted

as investment advice. Full terms and conditions can be found

at

Terms of Use .

USA

The Dow climbed more than 2% to close at 10586 on strong

volume, making a clear break above the high of early

January. The next major resistance level is 11500.

The Nasdaq Composite index and S&P 500 rose 3.1%

and 1.9% respectively, reversing the down-trend on

the short cycle.

Market optimism

The market brushed aside a profit warning from Oracle and

rallied strongly in the afternoon session.

(more)

Australia - ASX

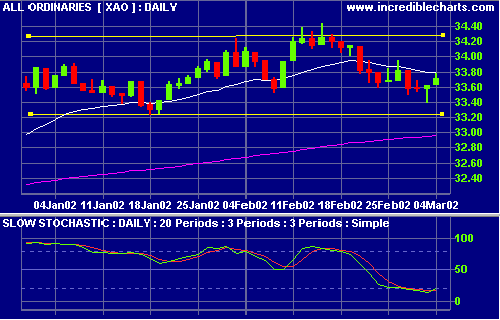

The All Ords reacted positively to the Friday

US markets, closing up at 3370 on strong volume.

The Slow Stochastic crossed to above its' signal line. The

reaction this morning has been positive, with the All

Ords up at 3386 at 11.00 a.m..

Woolies predicts double-digit growth [WOW]

Woolworths delivers a 24.3% rise in profits and forecasts

double-digit growth "for the forseeable

future".

(more)

EStar

EStar Online Trading is to re-focus from unprofitable online

broking division.

(more)

Conclusion

Short-term: Avoid new entries until the MACD joins

the Slow Stochastic above its signal line.

Medium-term: Wait for a new high on the All Ords

Long-term: Look for a secondary cycle reversal on the Nasdaq or

S&P 500 - if they break above their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Apologies for

the late delivery this morning. Please report if you experience

any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.