These extracts from my daily stock

trading diary are intended to illustrate the techniques

used in short-term share trading and should not

be interpreted as investment advice. Full terms and

conditions can be found at

Terms of Use .

USA

The Dow had another strong day, closing above the

10,000 resistance level, at 10,145 on reasonable

volume - up almost 1.8%. If the Dow breaks

above the 10,300 resistance level the secondary rally is

likely to continue.

The Nasdaq 100 soared 3.8% to close at 1,407 but is

still in a secondary cycle down-trend.

GM

surprise

Citing

better-than-expected sales, General Motors raised sales

and earnings estimates for the quarter and the full

year. (more)

GM is a lead indicator of the economy -

"What is good for GM is good for America".

Australia - ASX

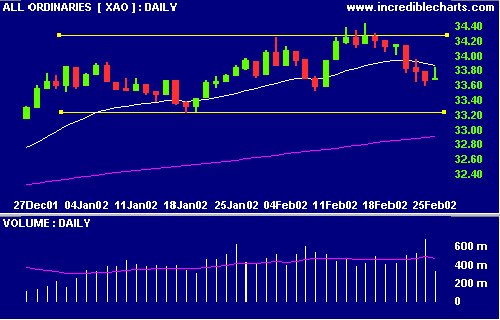

After an early rally the All Ords retreated to close amost

unchanged at 3368 on low volume. The MACD and Slow

Stochastic are both below their signal lines.

Back from the brink

[AUN]

Banks agree to an extension of

time for Austar to repay/rollover $400 million of

overdue debt. (more)

Lihir -

next? [LHG]

Newmont Mining CFO

says that they will either quit their 9.7%

stake in Lihir Gold or buy

more. (more)

Conclusion

Short-term: Avoid new entries until there are positive

signals from the MACD and Slow Stochastic (20,3,3).

Long-term: Wait for the US uncertainty to clear.

Colin Twiggs

P.S. We are trying out new Email software.

Please report if you experience any problems with the

trading diary.

Please forward this to your friends and colleagues.

Back Issues