These extracts from

my daily stock trading diary are intended to illustrate the

techniques used in short-term share trading and should not

be interpreted as investment advice. Full terms and

conditions can be found at

Terms of Use .

USA

The market is highly volatile with the

averages regularly posting gains/losses of 1% to 3%.

The Dow fluctuates in a trading range between 9,500 and

10,000, signaling uncertainty, while the Nasdaq

is in a down-trend.

Today the Dow gained more than 2% in

a late afternoon rally, to close at 9941 on high

volume. The Nasdaq 100 gained 1.5% to close

at 1408.

AOL

downgraded

Lehmann analyst Holly Becker downgraded AOL Time

Warner to market perform: "Our concerns fall

into four buckets: a slowing narrowband business, a

costly broadband transition, online advertising and

European expansion." (more)

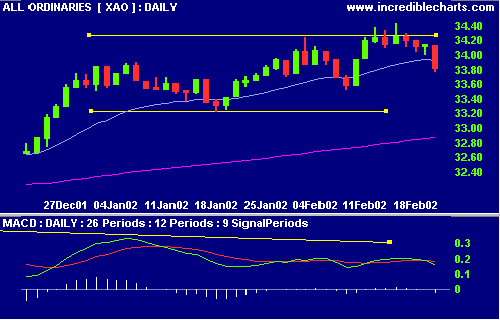

Australia - ASX

The All Ords declined sharply following

the earlier drop in the US markets, closing at 3383 on

large volume. The MACD has crossed to below its signal

line, joining the Slow Stochastic.

PBL [PBL]

Publishing &

Broadcasting profits are hit by the advertising

downturn and big gambling

wins. (more)

Wine merger

[MGW]

Brian McGuigan Wines and Simeon

Wines are to merge, blending "marketing talents with

production expertise". (more)

Short-term: Avoid further new entries until there is a

signal from the MACD and Slow Stochastic.

Long-term: Wait for a correction on the secondary cycle.

Colin Twiggs

P.S. We are trying out new Email software.

Please report if you experience any problems with the

trading diary.

Please forward this to your friends and colleagues.

Back Issues