Trading Diary

January 4, 2002

These extracts from my daily stock

trading diary are intended to illustrate the techniques used

in short-term share trading and should not

be interpreted as investment advice. Full terms and

conditions can be found at

Terms of Use .

USA

The Dow broke clear of the 10200 resistance level,

closing at 10259 on reasonable volume. The bearish

MACD

divergence appears to be over.

The Nasdaq was more subdued, closing 0.5% up at 1675.

Conditions ripe for a January rally

Abby Cohen, Goldman Sachs chief investment

strategist, says that conditions are ripe for "a notable

January rally". While Barry Hyman of EKN feels that

"high valuations should keep investors

prudent".

(more)

BUY, HOLD or Sell

Investment banks seem to be shy of making

SELL recommendations. (more)

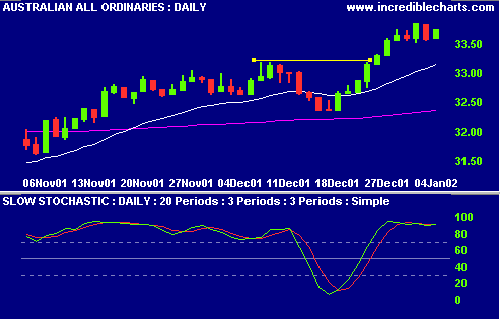

Australia - ASX

The All Ords closed up at 3374 on reasonable

volume. The

inside day indicates that there

is still uncertainty. The 20-Day

Slow Stochastic is in overbought territory, confirming

that this is not a good time to enter the market.

The bearish

MACD

divergence has weakened but should not be ignored.

Conclusion

It appears that the tide of optimism is carrying us into a

typical January rally. Bear in mind that February often

brings a correction.

There may be opportunities for short-term trading profits

over the next few weeks but be on your guard for a

correction. It is by no means clear that corporate profits

have recovered so stick to companies with sound

fundamentals.

Short-term: Tighten up on

stop

losses. Avoid new entries.

Colin Twiggs

Please forward this to your friends and colleagues.

To be included on our mailing list, reply

to this Email adding MAIL ME to the subject title.

All details submitted are protected by our

Privacy Policy.

Back Issues