Trading Diary

January 1, 2002

These are extracts from my daily stock trading

diary. They are intended to illustrate the techniques used in

short-term share trading and should not be interpreted as

investment advice. Full terms and conditions can be found

at

Terms of Use .

New Year Resolutions

Our resolution for 2002 is to continue the phenomenal growth

experienced in 2001:

-

Our immediate goal is to achieve 1 million page

impressions in a month. Present figures are 400,000

to 500,000.

-

This will enable us to expand the range and depth

of free services offered by Incredible Charts.

Plan the work and work the plan

A good resolution for traders is:

- To develop a sound trading system and to stick

to it.

The greatest strength that a trader/investor can have is

ability to stick to their preconceived plan in the face of

continual doubts, fears and conflicting information.

(more)

The first quarter

January is normally a good month for investors, with stocks

rising by more than the average month. February and March

historically yield below-average

returns.

(more)

USA

The latest rally on the Dow has failed to make a new high,

indicating uncertainty, while the bearish

MACD

divergence is still evident. The

down-trend on the Nasdaq continues.

The year ahead

Forecasters are predicting that the mild recession

will end and be followed by a gradual recovery.

(more)

Last year

Even the most pessimistic forecasters failed to predict

the depth of the recession in 2001.

(more)

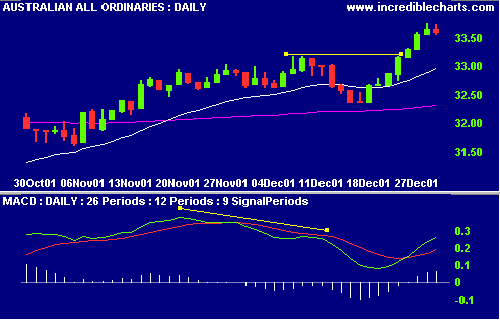

Australia - ASX

The All Ords has climbed to 3360 on weak volume.

The challenge here is to stick to the trading plan: there is

still a bearish divergence on the

MACD

so avoid new entries.

Conclusion

Short-term: The Dow still shows weakness and the

Nasdaq is in a down-trend. Tighten up on

stop

losses and avoid new entries.

Best wishes for the year ahead.

Colin Twiggs

Please forward this to your friends and colleagues.

To be included on our mailing list, reply to

this Email adding MAIL ME to the subject title. All

details submitted are protected by our

Privacy Policy.

Back Issues

Back

Issues

Access the Trading Diary Archives.